If your silver lining to all the interest rate hikes was that they would drive down prices and make it easier to buy a home, you better get out that spelunking helmet, tunnel some deeper shafts, and look for alternative ore extraction points. So far, the silver mine has been stubbornly unproductive.

It may seem like housing prices aren’t falling at all, depending on where you live. One of my podcast producers lives with his wife and baby in Los Angeles. They aren’t seeing too many real estate bargains, to say the least. If anything, the cost is rising right along with interest rates. I guess that’s the price you pay for the hope of one day bumping into George Clooney at Starbucks.

U.S. Housing Market Overview

Verified housing data is more valuable than anecdotal evidence and looks a bit different. U.S. home prices in April were down 4.1 percent compared to last year, selling for a median price of $407,857. The average number of homes sold was down 25.8 percent compared to the same period last year. The national average 30-year fixed mortgage rate currently sits at close to 7% percent — more than double where it was only 2 years ago!

But even this news doesn’t seem to be helping homebuyers. It’s like a different story with the same ending. The best way to describe the homeownership environment is with the term “rent control.”

The concept is drilled into your memory if you’ve ever lived in New York City. Rent control caps the annual rental increase and is a godsend for some. Let’s say you moved into an apartment ten years ago for $1,000 per month. Today, your rent may have only gone up to $1,100 even though the same size apartment could be rented to someone new for $3,000 or more! So as long as you stay in your apartment, you’re out of the line of fire. Capitalism can’t get you. But, the minute you move, wham!

The paradigm is similar to today’s mortgage climate.

According to Redfin data, at the end of 2022, 62 percent of mortgage holders had a rate below 4 percent, 82 percent had one below 5 percent, and 92 percent were below 6 percent. So, existing mortgage payments look very affordable relative to the cost of a new one today, where people might see something in the 6 to 7 percent range. This difference and a possible increase in home prices depending on location have made it difficult for people to move.

In other words, there’s a form of rent control for 90 percent of homeowners in the U.S.

According to realtor.com, 82 percent of recent or potential home sellers said they felt locked into their current homes because of a low mortgage rate. That percentage is higher for Gen Z (97 percent), Millennials (87 percent), and Gen X (87 percent). Baby Boomers did not share the feeling, likely because they’ve had the time to build more equity.

Rent vs. Own

Zillow produces a Home Value Index (ZHVI), a measure of the typical home value and market changes across a given region and housing type. It reflects the common value for homes in the 35th to 65th percentile range. It also offers an Observed Rent Index (ZORI), a smoothed measure of the typically observed market rate rent across a given region. It’s weighted to the rental housing stock to ensure representation across the entire market, not just those homes currently listed for rent. It computes the average of listed rents in the 40th to 60th percentile range.

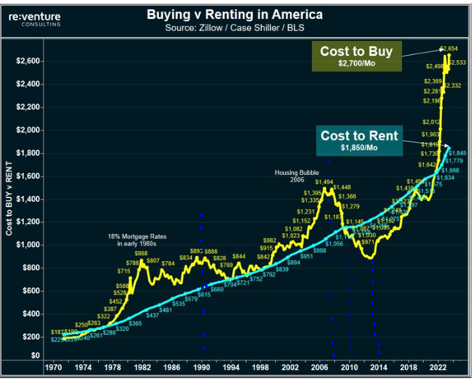

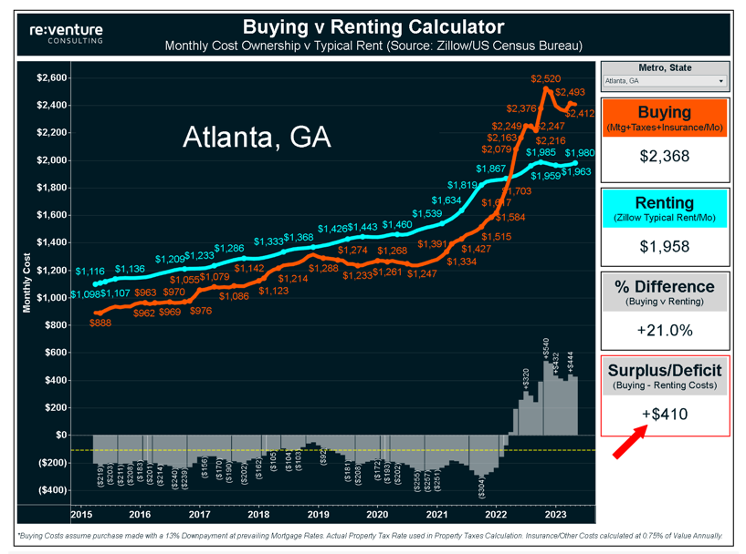

Using these Zillow tools, we see that since 1970, buying a home has typically been more expensive than renting. Using 1990 as an example, it costs roughly $900 per month to buy a median-priced home vs. $615 per month to rent. In 2008 those numbers were $1,400 to $1,000, respectively. Then, starting in 2010, home values fell, and things began to change. By 2014 it cost about$1,200 monthly to rent and only $1,000 to buy. That “better to buy” phenomenon lasted through 2021 and didn’t change until 2022, when home values went back up. Today, it’s much cheaper to rent: $1,850 vs. $2,700.

Bottom Line

With nearly 90 percent of homeowners feeling locked in to their homes because of the “rent control” of this mortgage rate dynamic, we will likely continue to see folks holding onto their houses longer and renovating more. Those with the financial means, who feel strongly enough about moving, will continue to do so.

Buying a home is once again a massive undertaking like it’s been for most of the last half-century. Is that fair to the youth of America? I’m not sure that’s the right question to ask. It’s certainly unfortunate. Trust me, I have four sons and can’t stand the thought of them struggling. But rather than being a matter of fairness, it’s more of a reversion to the cold hard economic normality, and it will likely stay that way for a while.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.