Nick Saban, one of the most storied and successful coaches in the history of college football, recently retired. His career took him from the University of Toledo to the Cleveland Browns to Michigan State, and then to LSU, where he won his first national championship. After a brief stint with the Miami Dolphins, he landed at the University of Alabama, where he coached the last 17 seasons, winning nine SEC and six national championships.

In other words, the person who builds his trophy cases has been gainfully employed for decades.

In 2023, Saban was the highest-paid coach in college football, earning $11.1 million. By retiring now, he walked away from a contract that would’ve extended through 2030, making him another estimated $71.8 million. To choose retirement over that kind of paycheck typically reflects financial security. Having the basics covered and then some, perhaps Saban is looking for more freedom and fewer limitations.

Everyone has a unique journey. After studying happy retirees’ habits for almost two decades and writing multiple books about it—You Can Retire Sooner Than You Think and What the Happiest Retirees Know—Saban’s decision piqued my interest.

Over the years, he has often discussed “The Process”—his approach to life and football. I want to take some of those lessons and apply them to retirement planning. After all, preparing for retirement is also a process.

Saban’s has five main principles.

1. FOCUS ON THE PROCESS, NOT THE OUTCOME

Football: Emphasize the high standard of competition necessary for success. Concentrate on the daily processes, tasks, and habits rather than fixating on the result. Take the required steps, and desired outcomes will naturally follow.

Retirement Parallel: If you need $1 million to retire, dreaming about it won’t help. It requires action. Invest your money—contribute to a 401(k), IRA, brokerage account, etc. Stay invested in the market, and don’t obsess over daily stock updates. Also, invest early and have the discipline to set aside money every paycheck. The sooner you start, the more likely you will reach your retirement goals.

2. ATTENTION TO DETAIL

Football: Coach Saban is known for his meticulous attention to detail, from practice drills to game planning. He believes that success is built on getting the small things right, and this approach contributes to consistency and excellence.

Retirement Parallel: Retirees have to game plan for retirement. Estimate your expenses. Choose an approach that makes sense for you, whether making a detailed list of necessary and discretionary spending or using an online calculator. Lower your costs to reduce the savings required to reach your target. Calculate how much you’ll need to save.

3. BUILD A STRONG TEAM CULTURE

Football: Coach Saban believes in creating a robust and positive team culture. By fostering an environment of mutual respect, hard work, and a commitment to a common goal, he helps players buy into the process and work together.

Retirement Parallel: Having the right financial team as you approach or enter retirement is essential. Working with a trusted financial advisor and a solid tax accountant can be a great formula for a successful retirement, and an estate planning or tax attorney might also come in handy.

4. HANDLING SUCCESS AND FAILURE

Football: Coach Saban teaches his players to handle success and failure with equanimity. Maintaining focus and humility during successful periods and learning lessons from failures are crucial components of his coaching philosophy.

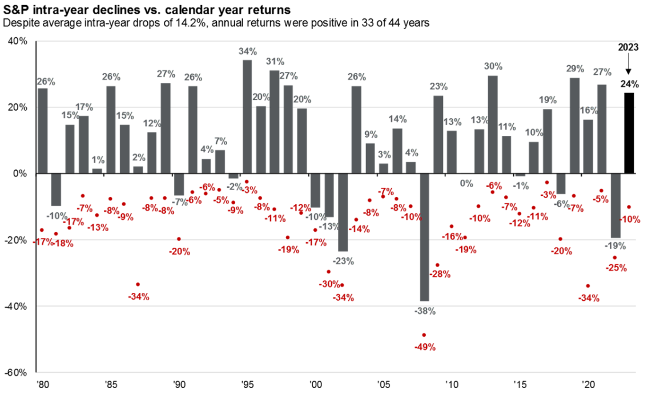

Retirement Parallel: It can be scary to stay invested. From 1980 through then end of 2023, the average intra-year decline in the S&P 500 was 14.2%. Despite this, annual returns were positive in 33 of the past 44 years. The market may not always be smooth, but history shows it typically ascends over time. Success in the market requires the patience not to cash out prematurely and the confidence to watch temporary losses during tumultuous periods.

Source: JPMorgan

5. LONG-TERM VISION

Football: While it attempts success at every stage, Coach Saban’s process is not geared solely toward short-term wins. He has a long-term vision for building sustained excellence, and this perspective influences decision-making and planning.

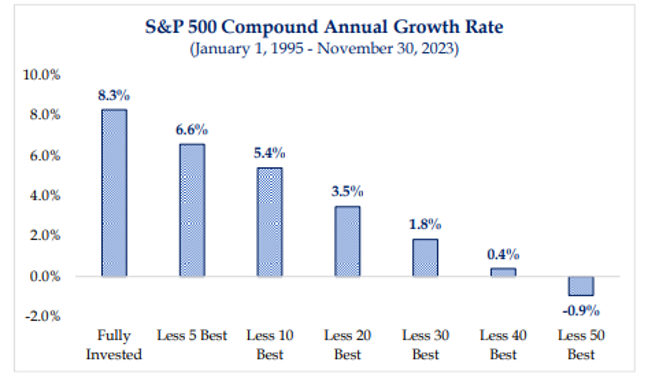

Retirement Parallel: Ultimately, our goal is to be happy in retirement. Don’t get fixated on daily stock market moves or scary financial headlines. History shows that time in the market generally beats attempts to time the market.

Source: Strategas

BOTTOM LINE

Coach Saban’s process extends beyond the football field, serving as a framework for success in various aspects of life. By focusing on the journey, continuous improvement, and strong principles, he created a legacy of success that transcends football and can even help us become the happy retirees we were meant to be.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. There will be periods of performance fluctuations, including periods of negative returns and periods where dividends will not be paid. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions,