The holidays are behind us. As we regain our fighting form, let’s take a moment to gaze downstream and see where the current seems to be heading. No one can predict the future, but specific trends can sometimes be clues.

The new year ushers in what could look like “A Whole New World” to investors. The genie is out of the bottle for several significant developments that create a decidedly unique economic landscape. The most significant inflationary surge since the 1970s helped trigger the highest short-term interest rates in twenty-two years. Generative artificial intelligence is being adopted at an extraordinary pace. A new class of Semaglutide drugs like Ozempic is revolutionizing advancements in American healthcare and celebrity waistlines. And, oh yeah, it’s an election year.

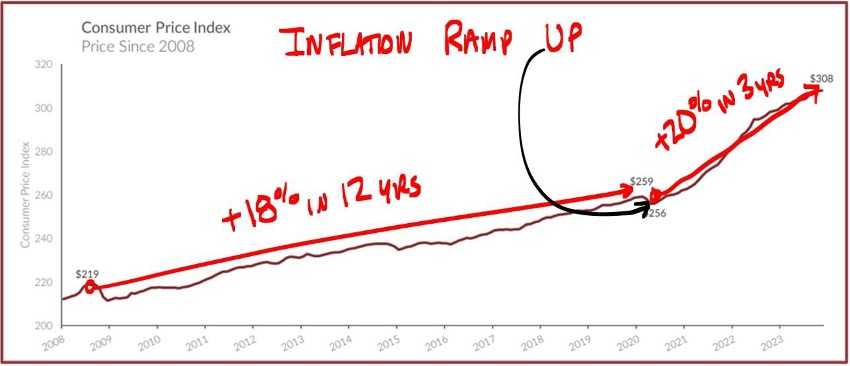

Wow. That’s a lot to digest. Rather than let it overwhelm us, let’s take a deep breath and proceed one step at a time. Combating inflation will most likely continue to require most of our attention. Protecting purchasing power is a perennial goal for the happy retiree, and that pursuit is more treacherous than it used to be. Inflation lay nearly dormant from 2009 to 2020 as if it were a prehistoric beast frozen deep inside an Arctic glacier. Unfortunately, the government’s post-pandemic monetary tidal wave reawakened it.

Source: U.S. Bureau of Labor Statistics

Let’s explore some themes and ideas that are of utmost importance for the year ahead.

- A Goldilocks U.S. Economy

The U.S. economy looks poised to grow at a rate between 1 and 2 percent this year, as measured by GDP. While that would be lower than in 2023 (estimated growth of 2.5 percent), growing 1 to 2 percent would put the U.S. in a “Goldilocks” zone—not too hot and not too cold. A slightly cooler growth would be significant, as it could allow the Federal Reserve to ease interest rates slightly, relieving pressure from mortgage rates and giving breathing room to stocks, particularly dividend-paying companies, more broadly. This scenario might also mean the U.S. economy continues to defy the odds of a recession that most economists were calling for last year.

Yes, we face more economic headwinds as pandemic-related excess savings have largely been spent, the cost of our government debt is rising, and commercial real estate vacancies are increasing. However, the Army of American Productivity encompasses the unstoppable momentum and resilience of the U.S. labor force, now 166 million strong, that continually drives innovation and economic progress. U.S. companies are the beneficiaries of this productivity, providing investors with significant long-term opportunities.

We can measure the health of that Army by answering the following two questions:

- Are workers receiving a paycheck?

- Are those paychecks growing?

As it stands today, we believe the answer to both is a resounding “Yes.”

The U.S. unemployment rate has stayed below 4 percent for the better part of two years. That means that over 96 percent of working Americans have a job.

Due to that tight labor market, wages grew by about 5 percent in 2022 but were wholly offset by inflation, which sat at over 6 percent. 2024 could be very different, with wage gains exceeding 4 percent over the last twelve months amidst an inflation rate bubbling above 3 percent. This sequence of events means the majority of Americans could see a real rise in their inflation-adjusted pay for the first time since that arctic beast emerged from the tundra.

Full employment plus real wage growth means a strong U.S. consumer, with more than 70 percent of the U.S. economy relying on continued spending by American households. In short, many signs point toward continued economic growth, barring an unforeseen economic shock.

- Broadening Equity Market Returns

For much of 2023, stock market returns were extremely concentrated to “The Magnificent Seven,” a handful of mega cap tech companies (Apple, Microsoft, Alphabet, Meta, Tesla, Nvidia, Amazon to provide context) that soared because of their proximity to the initial AI boom. As recently as November, virtually all of the S&P 500’s approximate 15 percent gain was attributed to those seven stocks. In other words, the market was higher regardless of the status of most companies within it. Fortunately for diversified investors and especially diversified income investors, the stock rally would ultimately widen the remainder of the year, encompassing more than just a handful of companies at the top. Still, the Magnificent Seven accounted for nearly 60 percent of the S&P 500’s 26 percent return, leaving the remaining 493 stocks up a healthy yet diminished 11 percent.

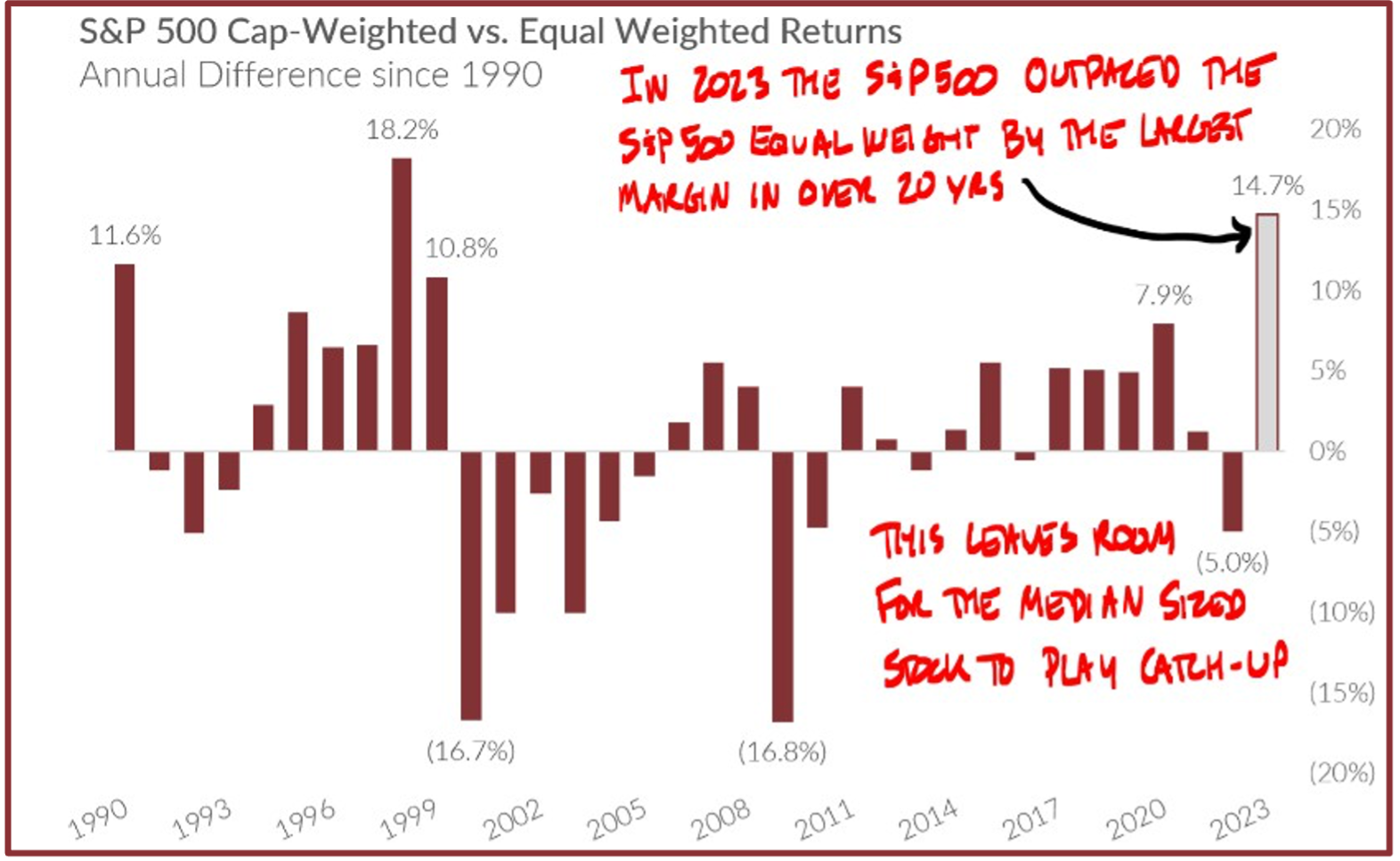

As the chart below shows, 2023 brought the widest divergence of returns between the traditional S&P 500 Index (cap-weighted and dominated by a few mega-cap-sized companies) and its equal-weighted sibling since 1998. It was the most top-heavy market in over two decades.

Source: Bloomberg

Reversion to Value & Divergent Valuations

Market history suggests a reversion to the mean, favoring the group that primarily took a back seat in 2023. In addition to mean reversion and investors adjusting to new inflation and interest rates, there is cause for optimism that stock market returns will broaden and smile upon the dividend-paying stocks previously shunned.

The surge in Magnificent Seven values last year leaves the group trading at lofty price-to-earnings ratios—a commonly used ratio to value a company based on its profits. Quite simply, investors are paying a whopping thirty-three times their projected profits while the average stock only trades eighteen times higher.

Valuations matter and could lead to a market cycle rotation moving away from this handful of names and shining a light on stocks more generally. Investors eventually notice when a group of strong companies is snubbed despite attractive valuations. We could see this play out in 2024, meaning a comprehensive move higher for the average S&P 500 stock.

Search for Dividend Yield

In an environment of moderating inflation and stabilizing rates, dividend-paying stocks and other income generators become more attractive. Investors seeking consistent returns may eye these stocks, particularly if bond yields don’t push higher.

These factors suggest a potential shift in investor focus, leading to a more evenly distributed market performance across various sectors and favoring previously underappreciated dividend-paying stocks.

- Bonds Are Back

In the world of bond investing; “yield is destiny”— meaning 86 percent of bond total returns are dictated by their starting interest rates. Low rates typically lead to sub-par bond returns. Higher rates like today usually indicate that the next few years of overall bond returns should show improvement.

The interest rate ripples of the past several years have settled as 10-year Treasury rates shot up from near zero to over 5 percent and then settled in at around 4 percent today. This reality means bonds have reemerged for their use in overall portfolio income generation and stability. With short-term interest rates reaching their highest in over two decades, the landscape of fixed-income investing has brightened.

Bonds have long been a valuable part of portfolio construction for income investors because of their income and stabilizing effect. In waters marred by constant economic uncertainties, bonds once again offer a safe harbor.

Counter-Cyclicality with Stocks

Another compelling attribute of bonds is their counter-cyclical nature relative to stocks. During stock market downturns, bonds often perform differently, providing a cushion against wild swings. By incorporating bonds into a diversified portfolio, investors can lower overall unpredictability, helping investors sleep well at night.

The resurgence of bonds and the broadening of stock returns rekindle the notion of a balanced portfolio, often called the “60-40 portfolio.”

- Remembering The Objective of a 60-40 Portfolio

Nobel prize-winning economist Harry Markowitz developed the logic behind the 60-40 portfolio. Since then, Wall Street has loved it, dismissed it, and now may love it again. But headlines about a balanced portfolio ignore the concept’s fundamental purpose—using asset class diversification to smooth out the investor’s glide path toward long-term goals.

60-40 is simply a proxy for diversification along the entire spectrum. Some lean heavily on stocks, while more conservative portfolios can carry higher percentages of bonds and cash. The methodology of using multiple asset classes together, the majority of which pay out income (dividends, interest, and distributions), is designed to protect purchasing power, manage toward personal risk tolerances, and most importantly, help folks reach long-term goals.

In fairness, this balance was less productive when interest rates hit historic pandemic lows. Now that interest rates have returned to more historical norms, bonds offer steady income levels while offsetting the volatility of stocks.

The potential for stable bonds to continue generating decent interest income and the possibility of persistent dividend stock staying power could lead to the balanced portfolio doing what it was designed to do—reduce overall risk and inconsistency while maintaining solid overall returns.

- Hedging Against Inflation Remains Critical

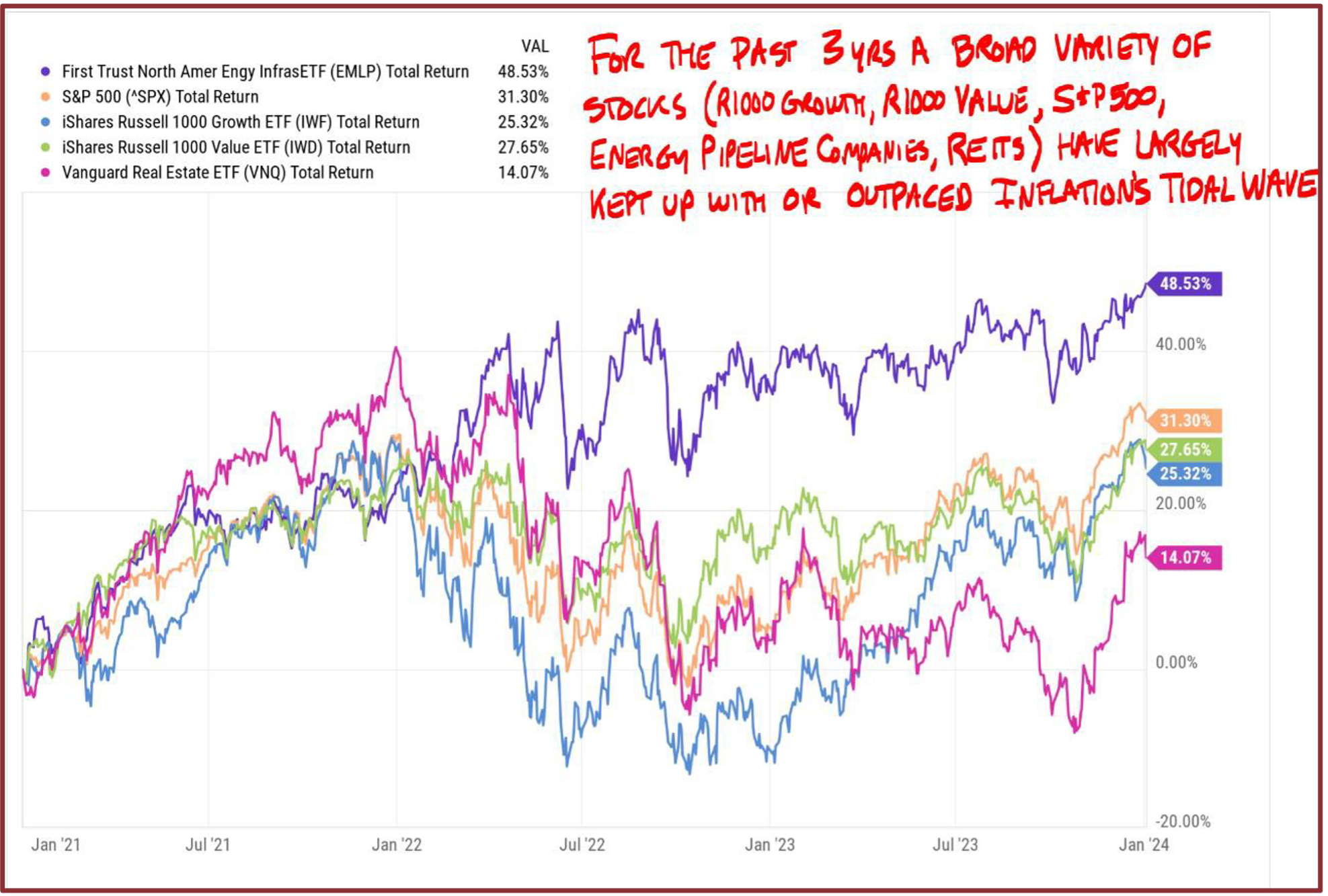

Despite more than 20 percent cumulative inflation over the past three years, there is good news. Namely, investment-focused families have largely stayed ahead of the inflation tidal wave. Even with rising costs, inflation-hedging assets have performed well. U.S. property values recently hit an all-time high, as did “net home equity” values for U.S. households.

As the chart below shows, growth and value/dividend stocks (Russell 1000 Growth and Russell 1000 Value) have climbed nearly 30 percent over the past three years, along with solid returns for real estate investment trusts (REITs) and energy pipeline companies. It will be critical to maintain exposure to these categories if investors want to continue to protect against the insidiousness of inflation. This “whole new world of 2024” could require an “all of the above” approach.

Source: YCharts; Capital Investment Advisors

Deglobalization

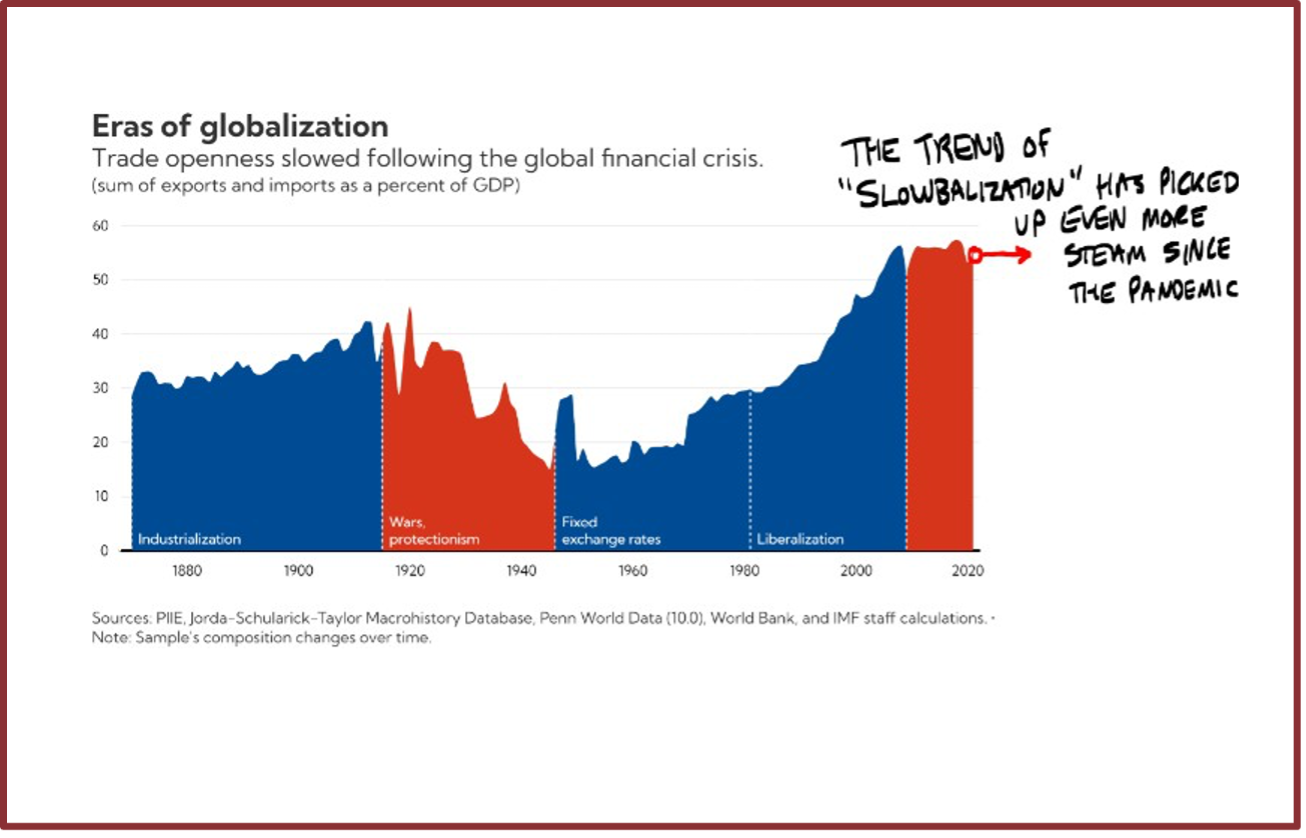

Deglobalization also referred to as “slowbalization” by the International Monetary Fund, began about a decade ago and has been exacerbated since the pandemic. For the better part of the past forty years, the trend of “globalization” has sought cheaper costs worldwide and helped tame inflation. However, as the chart below shows, that trend has stalled over the past decade. Less exporting and more “onshoring” and “reshoring” from U.S. companies could put inflationary pressure on the cost of living in the U.S. in the years ahead.

Source: International Monetary Fund

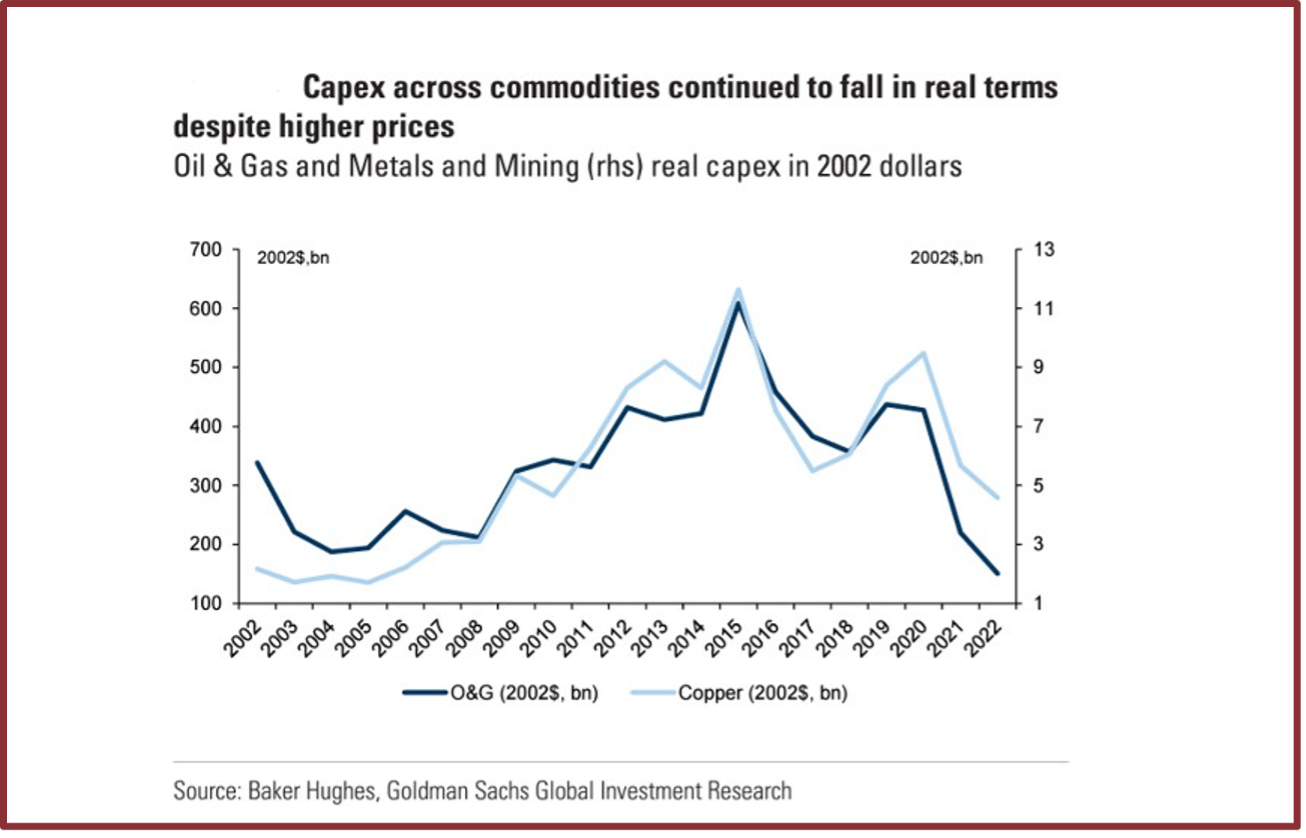

Commodity Underinvestment

We have also seen a dramatic slowing in capital expenditure in the commodity sector. Since 2014, spending on the exploration and production of oil, gas, and copper has fallen dramatically. This movement began with energy companies reacting to a sharp price drop in oil during 2014 and 2015 and has continued along with the growing emphasis on renewable energy sources, driven by climate change initiatives.

Source: Baker Hughes; Goldman Sachs

Deficit Spending and Rising Government Debt Levels.

U.S. government debt is no secret, clocking in at $34 trillion to begin 2024. Rising interest rates have meant the cost of servicing that debt has also grown. Increased borrowing without reigning in spending or addressing the issue would likely continue upward pressure on prices.

The list of reasons we will continue to see inflationary pressures is long and challenging. There are few answers to combating inflation besides investing in other assets that can increase at or beyond the inflation rate. A variety of stocks and other tangible assets (commodities and real estate) have long been arrows in the quiver for this fight.

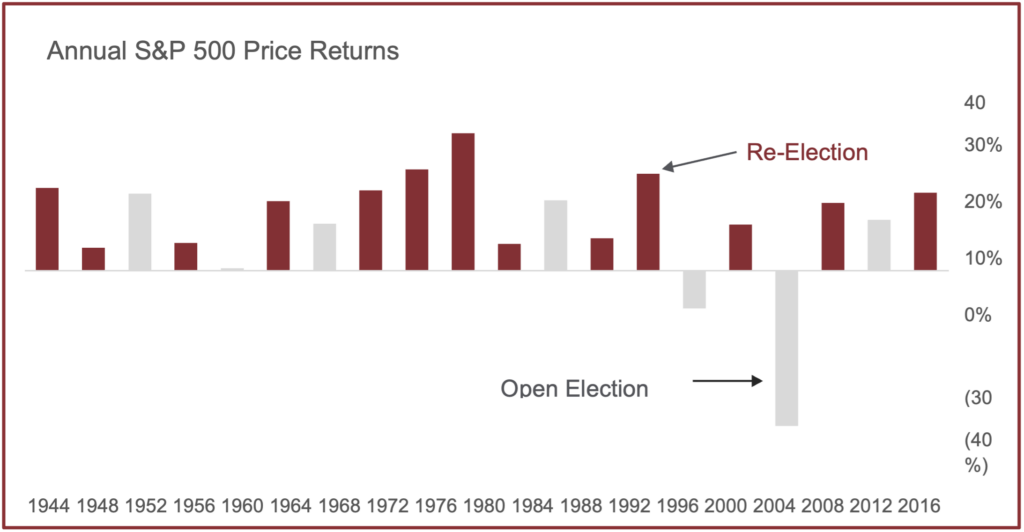

- Re-Election Year Implications

I’d be remiss not to address the elephant (and donkey) in the room. 2024 is a re-election year for the President of the United States. While we don’t know for sure who the candidates will be, we can take solace in knowing that re-election years have historically been good for the stock market.

Source: Bloomberg; Strategas; Capital Investment Advisors

The S&P 500 Has Increased Every Re-Election Year Since 1944

As you can see from the chart above, the previous thirteen presidential re-election years have seen positive returns from the stock market. The last time the stock market fell in a re-election year was 1940. While every cycle has unique circumstances, history has given us reason to be optimistic.

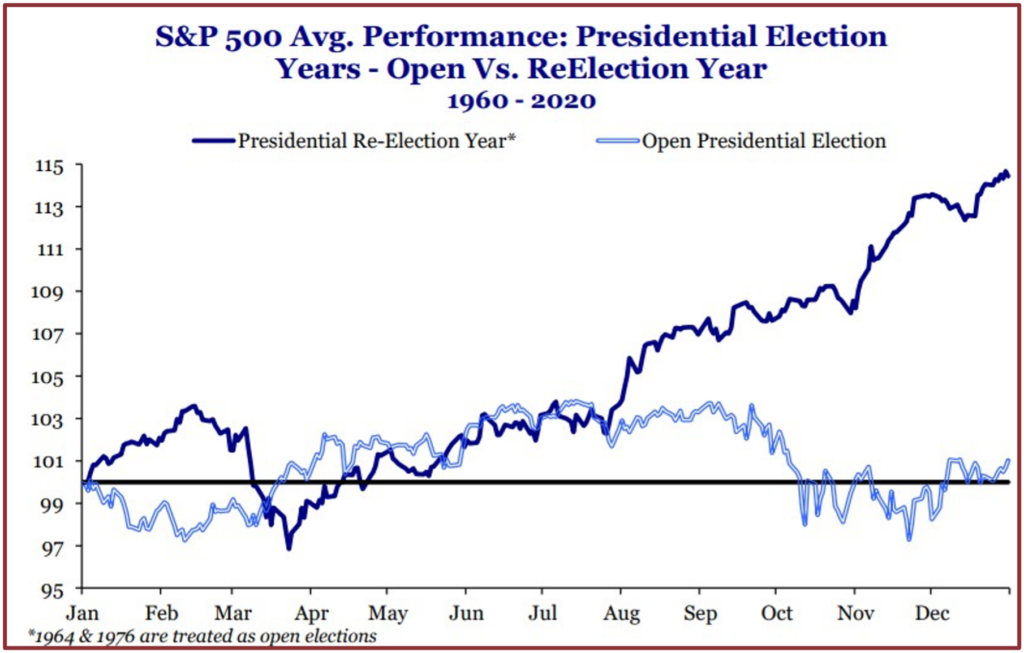

Stocks Have Historically Performed Better in Re-Election Years than Open Elections Years

Presidential re-election years are historically better for the stock market than open presidential elections. The S&P 500’s average return going back to 1960 is 13 percent better in presidential re-election years compared to open presidential elections.

Throughout political and economic history, it’s clear that any administration facing re-election (Republican or Democrat) prefers to stay in office. This desire often means using any and all tools at their disposal to create a robust economic report card. These moves (which vary depending on the economic environment of the day) will often provide some economic tailwind during election season.

Source: Bloomberg; Strategas; Capital Investment Advisors

It’s crucial to remind ourselves as investors that election years can draw up strong emotions both from a political and investment standpoint. While we can’t control which preferred candidate makes it to the Oval Office, we can position portfolios in a manner that weathers most political environments.

Bottom Line

2024 appears to offer exciting opportunities for investors. The New Year may usher in a whole new world with artificial intelligence and higher interest rates. Still, the tried-and-true practice of investing in a balanced mix of dynamic dividend-paying companies, along with steady fixed income, continues to appear strategically sound. The fact that many productive companies with durable business models took a back seat in last year’s returns might create exceptional value and opportunity for the year ahead. Bond yields are higher today than in most periods over the past 22 years. Coupling this with fundamentally strong companies with solid balance sheets, pricing power, and sustainable growth, we should be able to find the elixir we all seek to combat inflation for the long haul.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. The mention of any company is provided to you for informational purposes and as an example only and is not to be considered investment advice or recommendation or an endorsement of any company. The reader should not assume that an investment in the securities identified was or will be profitable. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. For stocks paying dividends, dividends are not guaranteed, and can increase, decrease, or be eliminated without notice. Fixed-income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed-income securities falls. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information is strictly an opinion, and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.