There’s a formula I’ve found during my extensive research on happy retirees. It ensures that you have the time of your life during your retirement.

Here’s a list of the top-five elements to be aware of and do before you retire. My list is in order of increasing importance:

1. Retire with no mortgage payment or be within five years of paying off your note.

2. Use the 1,000-Bucks-A-Month Rule to figure out how much you’ll need to meet your retirement budget.

3. Make sure you have multiple streams of income. Include your Social Security and/or pension benefits, rental income, part-time work income, and your investment income. (Spoiler – the happiest retirees have between three to four sources of income.)

4. Become an Income Investor.

5. Know what your money is for. Do “what you have fun doing.”

Let’s home in on number five. It refers to what I call “core pursuits,” and these are the building blocks for happiness during your post-career years.

Core pursuits are like hobbies but bigger – they’re the activities you’re really passionate about, and that bring you excitement and a sense of fulfillment while you’re doing them.

These are not just for current retirees. Core pursuits are for people in their 30s, 40s, and 50s. The sooner you develop them, the better. In addition to upping your happiness quotient when you do reach your Golden Years, they help you save better and invest better. That’s because you have a purpose for your money.

It doesn’t matter what you do. What matters is that you have core pursuits and that you engage in them regularly. Whether it’s volunteering or singing in the choir, painting or taking college courses, playing tennis or playing golf, all of these activities are core pursuits if they bring you happiness. Filling up your time with the things you love sets you up for a truly happy retirement.

To some folks, this seems like a no-brainer. Not because they’re loaded with core pursuits, but because they believe working was the hard part and you won’t have to work at having a happy retirement. This, my friends, is simply not the case. You have to know what you want to do during your retired years before you can enjoy doing it.

The research for my book, You Can Retire Sooner Than You Think, uncovered that happy retirees have an average of 3.6 core pursuits, while the unhappy lot has only 1.9. Core pursuits are that critical to living a happy life in retirement.

No matter how far away you are from calling it a career, now is the time to explore, develop and engage in core pursuits.

I get questions regularly about how to develop core pursuits. Folks are wondering how they get to “3.6” core pursuits. The theme of these questions is, “How in the heck do I figure out what I’m going to do for the next 30 years?”

I want to share something here with you. This year, my dad retired after 43 years of workings as a veterinarian. He sent out a letter to his clients, and it’s right on point with our topic.

“I must admit that I approach this change of life with mixed emotions. While stepping away from veterinary medicine is hard, as many of you know I have a few other interests that I look forward to pursuing (geology, Civil War medicine, fencing, leatherwork, fox hunting, trail riding, woodworking, sewing, time-traveling through historical reenacting (Civil War, Revolutionary, Pirate), music (guitar, singer-songwriter), art, cooking, cowboy poetry, and more! I also look forward to spending more time with our family (four grown children and eight growing grandchildren) and supporting my wife Anne’s interest and career in pottery and equine pursuits.”

I may be biased because he’s my dad, but I love this letter. It’s chock-full of exciting core pursuits. It also shows that my father has a clear picture of how he’ll choose to spend his retirement years. Fantastic.

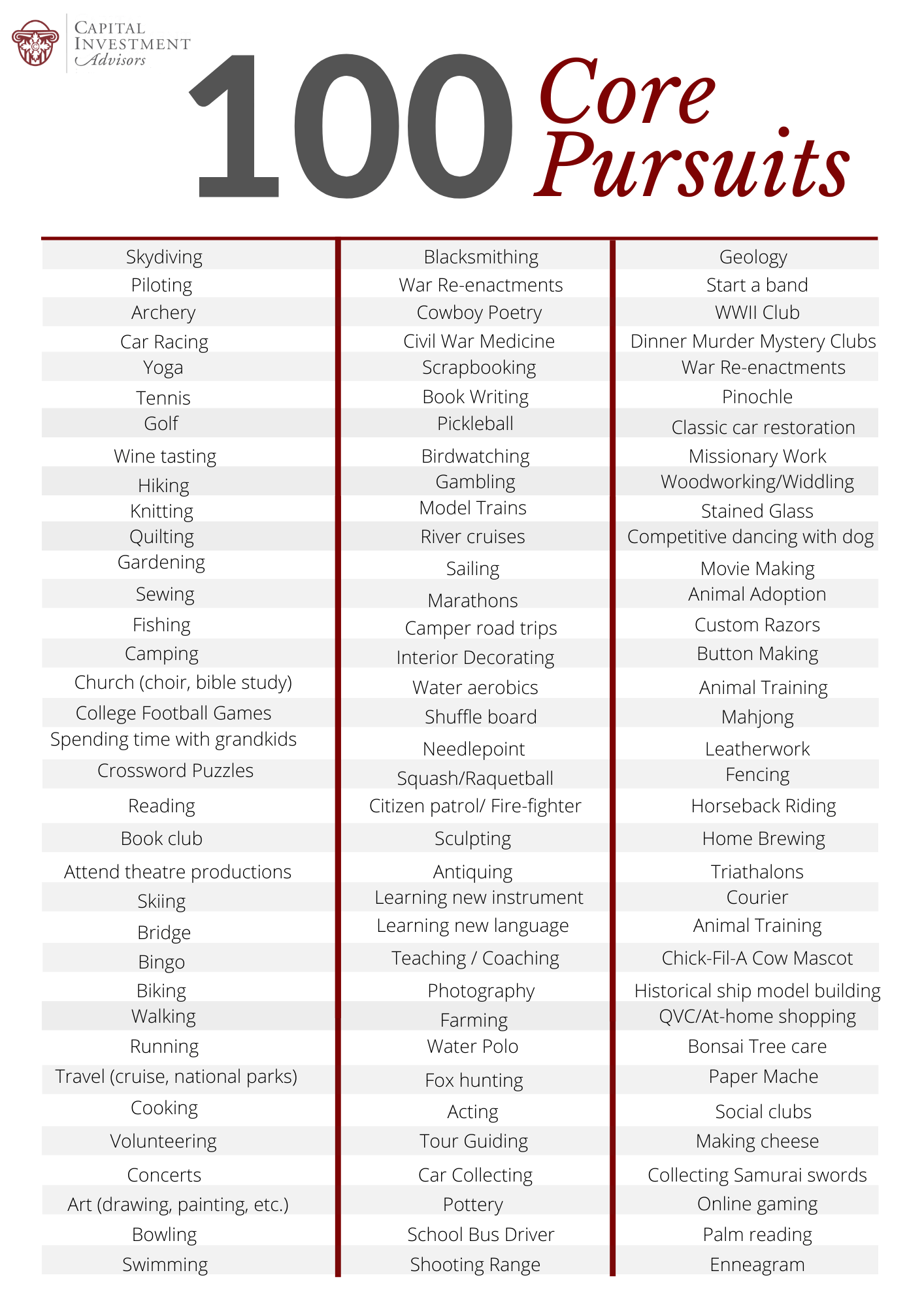

To delve deeper into what people choose as their core pursuits, I did a mini-experiment. I sent a survey to all 40 of the folks at Capital Investment Advisors. In it, I asked them to tell me some of the most memorable core pursuits they’d come across while working with our clients.

It was a fun exercise, and we can up with quite a list.

Most of the core pursuits fell into four categories. There was part-time work, like teaching, consulting and decorating. Then there was exercise and health – things like hiking, biking, swimming, and walking. The arts were a big one, with cooking, painting, and music making up a chunk of the list. And then there was adventure, such as travel, cruising, RVing, piloting and sailing.

Take a look and see if some of your core pursuits are listed below:

The list is endless for the happy retiree. Your only limitation is your creativity and openness to try new things.

You can be a real go-getter and try to do all 100, but the key is three or four at a minimum. Just don’t do zero – I want you to be a happy retiree. Just think about how much fun you’ll have! And the wonderful part is, as long as you’ve planned for these core pursuits and are financially ready to support them, you have so much to look forward to during retirement.

Explore these examples and sample whatever seems interesting to you. If this list seems overwhelming and you’d like us to help you find an activity that fits best in your lifestyle, try our Core Pursuit Finder.

This information is provided to you as a resource for informational purposes only. It is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. The information contained in this piece is not considered investment advice or recommendation or an endorsement of any particular security. Further, the mention of any specific security is solely provided as an example for informational purposes only and should not be construed as a recommendation to buy or sell. Always consult your own legal, tax or investment advisor before making any investment/tax/estate/financial planning considerations or decisions.