Making money is hard. Even though I’ve been fortunate to meet many of my financial goals, I still feel a sense of accomplishment and relief when that “check” clears. Maybe it’s different for billionaires, but then again, maybe not. Most folks remember the trauma of staring into the abyss of an empty bank account.

It’s not surprising that once people have earned enough to invest for the future, they feel highly anxious about volatile market swings. In my two decades of working in the financial industry, I’ve found this to be one of the most challenging aspects for folks to handle.

An amusing anecdote about the famously wealthy Ted Turner illustrates my point. As the story goes, he received many Time Warner shares in his sale of CNN in 1996. He installed a stock-tracking ticker tape machine in his office, but this led to it tormenting him as he would see most of his net worth rise and fall daily. It became more than he could bear, and he eventually sold off a considerable portion of his stocks to invest in real estate.

This tale may or may not be apocryphal, but the moral is that not even Ted Turner was immune to the emotional highs and lows of gain and loss. So, don’t be discouraged by your mercurial temperaments because you’re in good company. Anxiety is part of the human experience. It’s what kept our ancestors safe from danger. You can’t eradicate it, but you can learn to filter its effects.

One method I’ve found to be helpful is to use history as a guide when reviewing two fundamental investing principles.

1. Timing Matters, But Not As Much As You Might Think.

I’d prefer to buy a stock at its nadir than its peak to reap the spoils of a possible upswing. But we can’t let this quest consume us because we don’t have a crystal ball. Yet, here’s the good news. In the U.S. economy, investment results with bad timing have generally still been pretty darn good.

This sentiment leads us to principle two, which tends to trump the first.

2. Time In The Market Is Typically More Important Than Timing The Market.

The dream of a perfect investment plan is just that — a dream. People do win the lottery, but if it were a common occurrence, it wouldn’t be the lottery! If you allow a perfect plan to become the enemy of a good one, you’ll most likely regret it. Instead of focusing on the right time to get in, focus on how costly it can be to get out. The math behind the power of remaining fully invested is stunningly clear, and trusting the consistent trends the statistics layout is vital to your long-term success as an investor.

On bad days in the market, your body can secrete the primary stress hormone known as cortisol to warn you of danger. “Abandon ship!” I know I’ve felt the same survival instincts. However, years of experience have taught me the flaw of this approach, so I asked my research team to pull our market timing data as evidence. The results show how ruinous it can be to flee when times are tough.

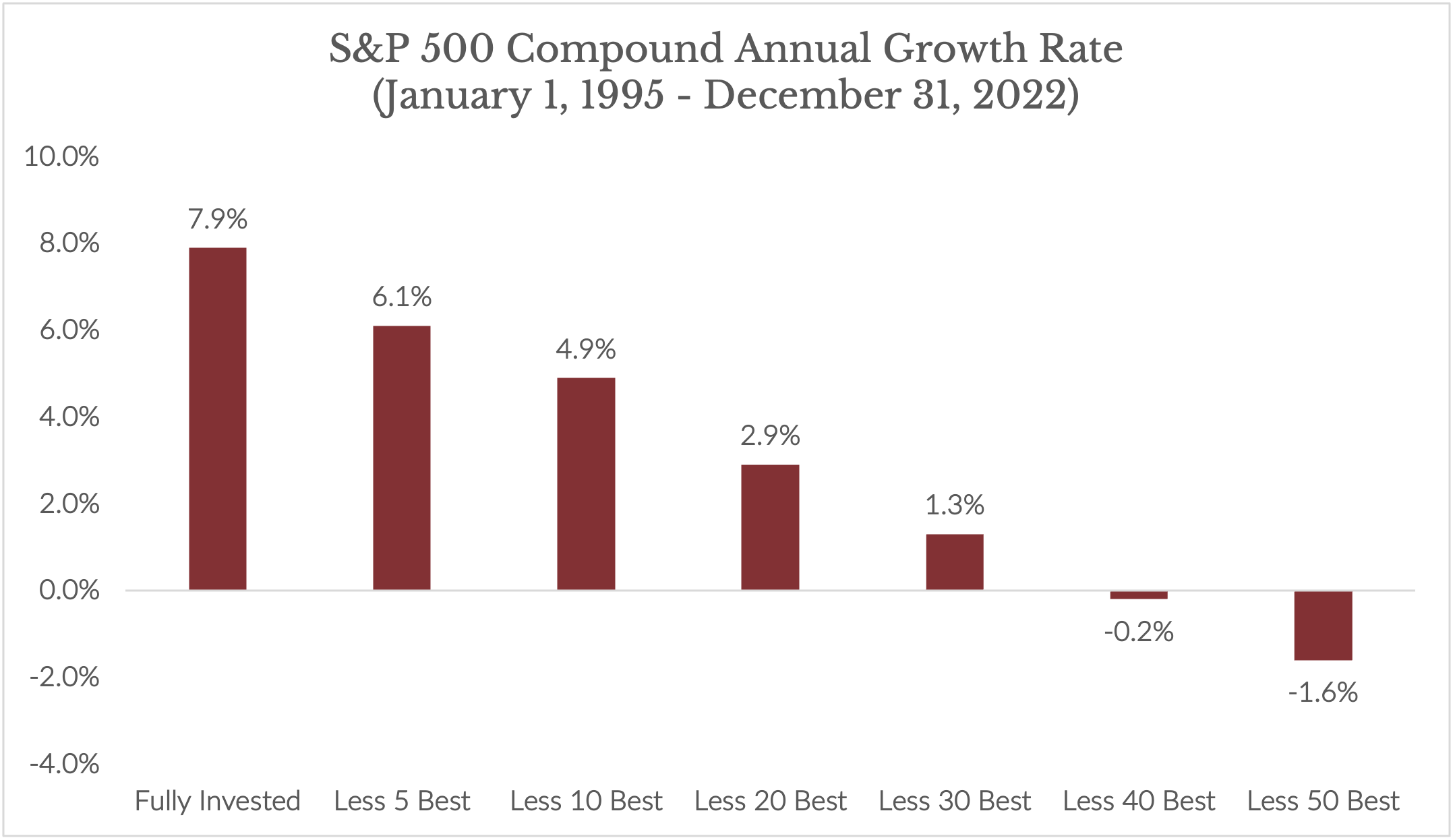

Source: Strategas; Capital Investment Advisors

Looking back at the S&P 500 annual growth rate of return from January 1995 through December 31 of 2022 gives us nearly thirty years to study. The tumult of multiple bear markets and recessions still produced an average total annual rate of return of about 7.9%.

But what if an investor missed just a few of the best days in the market over that colossal period? Our research team at Capital Investment Advisors ran the numbers, and here’s what we found.

Missing the five best ones cuts the rate of return from about 7.9% to 6.1%. Still a respectable number, but that’s a 23% reduction compared to the full per year return you would have gotten if you would have stayed invested. All because an investor got nervous and pulled money out for just five trading days!

Let’s say we miss the best ten days. This drops the rate of return down to 4.9% a 38% decline. So a person who had a short-lived lull in faith now has a forever unrequited love affair with the money they would have earned.

Say we miss the best twenty trading days. The overall return would drop by 63%, bringing it down to 2.9%. Depressing, right? At thirty days, the rate of return falls to 1.3%. That’s less than inflation, less than long-term money markets. Try forty days or fifty days. Now it’s in negative territory.

As you can see, just a snippet of time wasted can lead to a hair-raising abundance of missed opportunities. If your strategy is to enter and exit the market according to declines and rebounds, you could save yourself the hassle and put your money in a savings account.

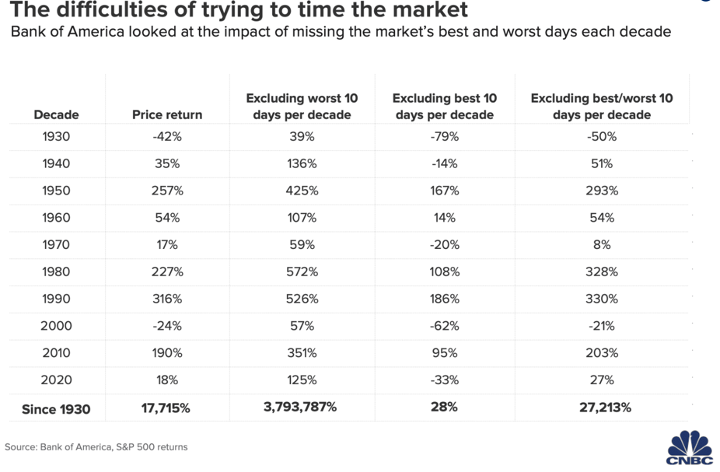

Bank of America recently published a study that examines each decade’s returns from the 1930s through 2020. The research tells a similar story, but by decade.

Let’s look at the 1950s. Fully invested, the return of the S&P 500 is a little over 250%. Miss just the ten best days of the decade, and it drops to 167%, or by more than one-third. Examine the 1980s. The total price return for the S&P 500 was 227%. Without the best ten days, it becomes 108%, or 52% less. In undesirable market decades like the 2000s, the price-only return of the S&P 500 was -24%. But if you missed the best ten days, your loss tripled to -62%.

If your preconceived notions are still making you doubt the data, note that often, the biggest market recovery days bookend the worst. For example, on October 27, 1997, the market fell 6.9%. The next day, it rose 5 percent.

On August 31st, 1998, the market fell 6.8%, and then on September 8th, markets were up 5% in just one day. On November 20th, 2008, it was down 6.7% in a day, followed by a 6.3% rise on November 21st, 2008. The market fell a whopping 12% on March 16th, 2020, and then on March 24, 2020, it increased by 9.4%. Then, it rose another 6.2% on March 26th, 2020. Unlike the Ted Turner story, this is information you can corroborate.

The bottom line is that most investors are rewarded for staying the course. It is often beneficial to remain invested in reliable, high-quality companies, diversify, remain calm, and practice self-control over substantial stretches.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. For stocks paying dividends, dividends are not guaranteed, and can increase, decrease, or be eliminated without notice. Fixed-income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed-income securities falls. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions,