Have you noticed that your paycheck isn’t going as far as it used to? My guess is probably so. This drag on your wallet is due in no small part to the current inflation rate.

Over the past few months, inflation has rocketed upwards, reaching the 7% to 8% mark. And, it doesn’t appear to be going away soon; even if the levels drop below the current peak, we’re unlikely to live in the heyday of the 1% to 2% range we’ve gotten used to over the past two decades.

Everywhere I look, I see clues that point towards real, continued and sustainable inflation. Because of where we find ourselves in the current economic environment, let’s unpack what inflation is.

Typically, we define inflation in terms of imbalances and supply versus demand. When there’s a shortage of cars, then car prices will go up. When there’s a labor shortage – like we’ve seen in sectors ranging from manufacturing to health care – the shortfall pushes up prices. And in terms of the 4 million house shortage, (you guessed it) mortgage prices spike.

This characterization of inflation is straightforward enough. But the greater culprit doesn’t get as much attention, although it’s well-deserving of it. What I’m referring to is the amount of money we have circulating through the economy. This factor is something that economists measure and is the foundation for increased prices.

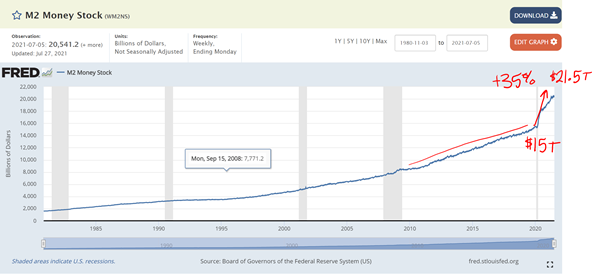

The definition of our money supply, or “M2” as it’s referred to in the financial industry, includes three major components. The first is the total amount of small denomination deposits, or everyone’s checking account that’s under $100,000. Next are all of the money market funds – the investments you hold in your brokerage accounts. And last are all of the deposits made across the board. This final point allows economists to gauge how much cash is sloshing around in our economy.

We know that inflation is created by too much money chasing too few goods, so M2 is the most essential variable when we talk about inflation. And we are knee-deep in the land of inflation in the U.S. right now.

In fact, over the last year and a half, we’ve experienced the sharpest increase in M2 since America was preparing for WWII. We’re topping out at a whopping 35%! As one example, look at the below graph to see how our money supply has risen over the past forty years. We’ve gone from $2 trillion in M2 to $21.5 trillion. Massive.

To illustrate how this works for everyday American consumers, imagine that you have $100 in the economy. Avocados are a buck, so you can buy 100 avocados. But say the money supply increase to $130. Now each avocado is $1.30, or 30% more expensive. Factor in the constraints of COVID, and let’s figure there are only 60 avocados available. Then, the M2 is $1.30 divided by 60, or $2.16. An avocado has nearly doubled in price (and guacamole just became a luxury!).

This simple sketch is precisely what’s happening in the U.S. today.

One of the Federal Reserve’s most critical responsibilities is to provide a cushion and an insurance policy against a depression when the economy is overloaded with cash. So here we are, after 2020’s COVID shutdown. The U.S. is back up and running again with similar demand as previous years, only with 30% more money than before. It’s too much. Those dollars are chasing too few goods.

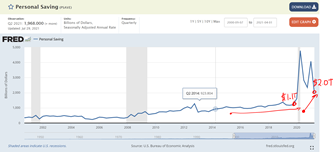

As for Americans’ personal savings, we’ve seen an almost doubling of the total we have saved, up from $1.1 trillion to $2 trillion. Following suit were IRA and 401(k) balances. On average, IRA accounts reached $134,900, up 21% from last year, while 401(k)’s topped out at $129,000, up 24%.

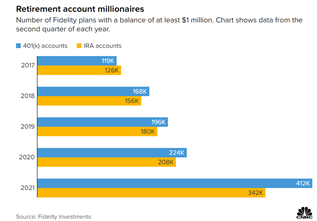

Following suit with these upward trends in retirement savings, the number of 401(k) and IRA millionaires hit fresh highs. A record 412,000 folks have Fidelity 401(k) plans with a balance of $1 million or more as of the second quarter of 2021. Similarly, the number of IRA millionaires increased to 342,000, another all-time high.

Take a look at the graphs below for a visual of these jumps.

Put them all together, and we have 754,000 people joining the millionaire’s club! What’s most astounding to me is that the total number of retirement millionaires has nearly doubled from one year ago.

Our bottom line is this: we have to see prices rise by 30% over time. Maybe it will be in three years with 10% inflation, or perhaps in six years with 5% inflation. From where I stand, stocks, real estate and other assets designed to inflate along with inflation are the best bet. Using these investment vehicles wisely, we should be able to combat the massive balloon of cash moving through our U.S. economy.

Disclosure: This information is provided to you as a resource for informational purposes only. It is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. The information contained in this piece is not considered investment advice or recommendation or an endorsement of any particular security. Further, the mention of any specific security is solely provided as an example for informational purposes only and should not be construed as a recommendation to buy or sell. Always consult your own legal, tax or investment advisor before making any investment/tax/estate/financial planning considerations or decisions.