To say that my wife Amanda loves the musical Hamilton would be an understatement. I remember how excited she was when we went to see it live at the Fabulous Fox Theatre six years ago. My favorite part, aside from seeing how enraptured Amanda was throughout the entire performance, was the first song of the second act, Thomas Jefferson’s, “What’d I Miss.”

If you are unfamiliar with this jazzy number, allow me to set the scene. It is the year 1789. Thomas Jefferson has been serving as the Ambassador to France (from 1784 to 1789) in the aftermath of the American Revolution and preliminary stages of the new U.S. Constitution. President George Washington calls Jefferson back from across the pond to serve as the nation’s first secretary of state. A frustrated James Madison is at Jefferson’s Monticello home eagerly awaiting his arrival. Before Jefferson can set down his suitcase, Madison launches into his misgivings with the current Secretary of the Treasury, Alexander Hamilton. To which Jefferson flippantly responds in song, “So, What’d I Miss?!?”

Now, I have not been in Paris for the past five years, but I totally missed two bills that were passed by the Georgia Assembly and signed into law by Governor Brian Kemp amending Georgia Income Taxes (O.C.G.A. Title 48, Chapter 7): House Bill (HB) 1437 (signed April 26, 2022) and Senate Bill (SB) 56 (signed May 2, 2023). Apparently, I was, “out of the loop.”

So why talk about them now?

It is tax season, likely the most (un)wonderful time of the year.

No one likes taxes, not even accountants. To quote a recent advertisement from TaxAct, “TaxAct understands you don’t exactly look forward to filing taxes. TaxAct doesn’t even look forward to taxes. And TaxAct is a tax company. TaxAct…Let’s get them over with.”

This applies to Georgia state taxes and for Georgia residents and tax filers. This does not apply to anyone filing other state returns. I am not going to bury the lead. You will still need to pay state taxes, but the changes affected by HB 1437 and SB 56 might make it a little less painful for Georgia residents starting in 2024. Here is why.

Together these bills replace the current progressive six (6) income tax bracket system (ranging from 1% to 5.75%) with a new flat tax rate of 5.49% beginning January 1, 2024, which shall be reduced by 10 basis points annually beginning January 1, 2025, until the flat rate reaches 4.99% if the Governor’s revenue estimate, net revenue collection and Revenue Shortfall Reserve targets are met. If all goes according to plan, the flat tax rate reduction schedule could hypothetically look something like this:

- 5.49% (effective 1/1/2024)

- 5.39% (effective 1/1/2025)

- 5.29% (effective 1/1/2026)

- 5.19% (effective 1/1/2027)

- 5.09% (effective 1/1/2028)

- 4.99% (effective 1/1/2029)

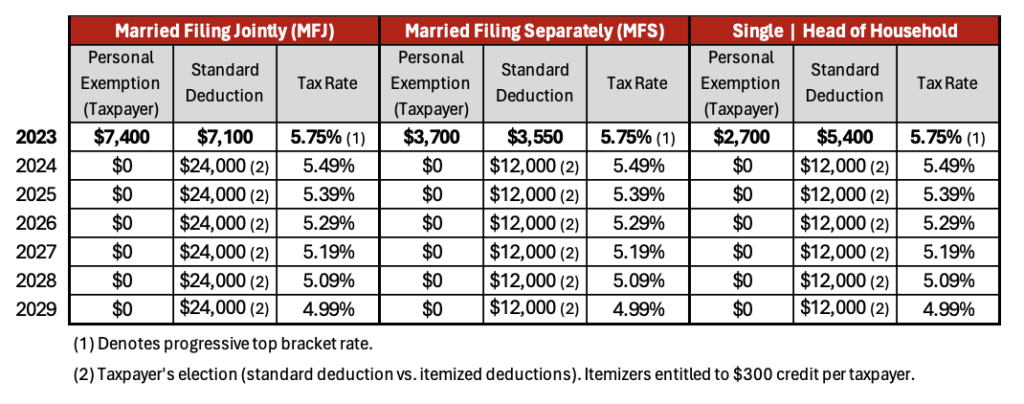

In addition to introducing the flat tax rate, the passed legislation also modifies the personal exemption and standard deduction. The Tax Year 2023 personal exemption of $7,400 for married filing jointly (MFJ) taxpayers, $3,700 for married filing separately (MFS) and $2,700 for single and head of household (HoH) taxpayers is eliminated effective January 1, 2024. It is important to note that the personal exemption for each dependent of a taxpayer ($3,000 for each dependent) remains unchanged.

The Tax Year 2023 standard deduction of $7,100 for MFJ taxpayers, $3,550 MFS taxpayers and $5,400 for single and HoH taxpayers will increase to $24,000 for MFJ taxpayers and $12,000 for MFS, Single and HoH taxpayers effective January 1, 2024. Furthermore, effective January 1, 2024, the taxpayer may elect either the standard deduction or the sum of all federal itemized deductions (Schedule A – Form 1040). Those who elect to itemize are entitled to a $300 credit (per taxpayer).

The table below outlines the changes under the current law a little more clearly.

The first point I will make is that what these two bills eliminate under the new law they give back in spades. Said another way, Governor Kemp did not, “close the door without opening a window.”

Single and HoH taxpayers are stepping up from combined deductions of $8,100 ($2,700 personal exemption + $5,400 standard deduction) to a $12,000 standard deduction in Tax Year 2024. That is a relative increase of 48% in deductions before claiming a qualified dependent. MFJ and MFS benefit from a 65% relative increase in deductions in Tax Year 2024 before claiming a qualified dependent. And when you couple that with the new reduced flat tax rate, the savings really start to add up.

How much you might ask?

That depends on the situation. Let’s run the numbers on two hypothetical examples to get a better idea.

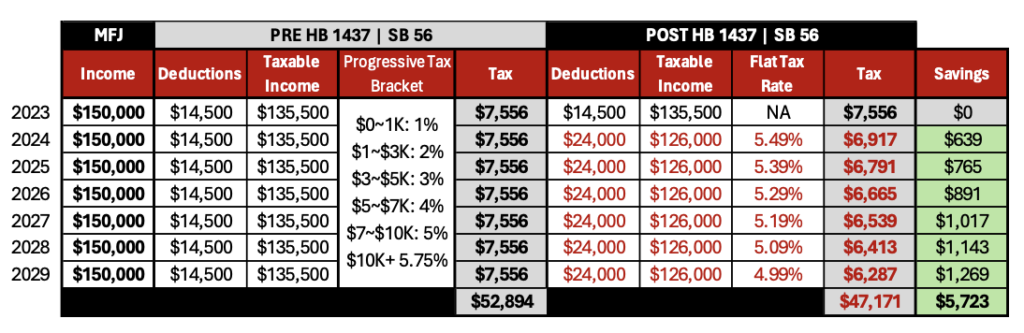

Meet newlyweds Mary-Frances and John (MFJ) who make $150,000 a year and file jointly. Dual income, no kids and still in their honeymoon phase living the dream in their Midtown apartment. As you can see from the hypothetical projection below Mary Frances and John would have paid almost $53,000 in Georgia income tax under the old tax code (Pre HB 1437 | SB 56). Under the new tax code, Mary-Frances and John could save over $5,700. That is an average of $954 per year (from 2024 through 2029). Will this make Mary-Frances & John rich? No, of course not. But they might find a better purpose for that money more aligned with their financial goals. What if they applied those tax savings toward a home purchase and were able to itemize their property tax and mortgage interest (along with their state taxes) and start a family (qualified dependents)? Yes, their expenses might go up, but their Georgia income tax might be reduced even more.

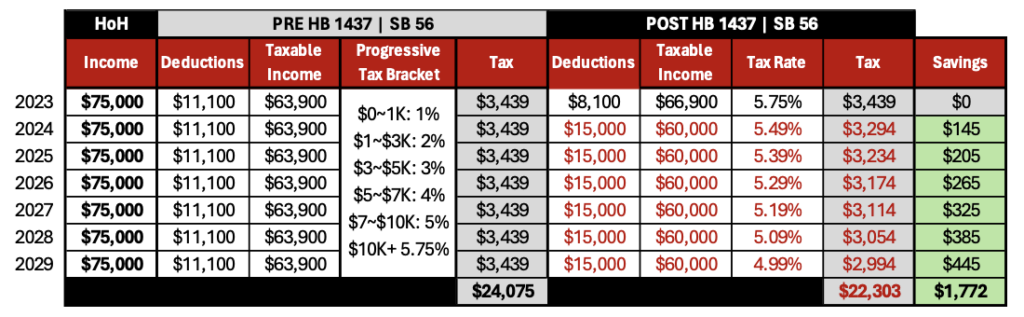

Next up is Head of Household, Holly. Holly is a single mother of Harry (HoH). She makes $75,000 per year and yes, she’s just wild about Harry (and Harry’s wild about her). Under the old tax code (Pre HB 1437 | SB 56) she can take $11,100 in total deductions ($2,700 personal exemption + $5,400 standard deduction + $3,000 qualified dependent for Harry). Under the new tax code (effective Tax Year 2024) her deductions total $15,000 ($12,000 standard deduction + $3,000 qualified dependent for Harry). In the hypothetical projection below, Holly could save just over $1,770 which is an average of $295 per year from 2024 through 2029.

When I think of governors, two jump to mind almost immediately. The first is 76-year-old, former professional body builder, actor, filmmaker, businessman Arnold Schwarzenegger, aka “The Governator” who served as the governor of California from 2003 to 2011. The second is Governor William J. Le Petomane played by Mel Brooks in one of my favorite movies of all time, Blazing Saddles. But considering the passage of HB 1437 and SB 56, Governor Kemp is now in the mix. I would be happy to join his cabinet meetings and give him a “harrumph.”

Bottom Line

No one likes taxes.

So, in case you missed it (like me), you are officially up to speed on what Governor Kemp has publicly touted as, “the largest income tax cut in state history” which includes the following:

- Changing the calculus of the Georgia state income tax from a progressive six (6) bracket system with a top rate of 5.75% to a flat tax rate of 5.49% effective January 1, 2024.

- Reducing the flat tax rate by 10 basis points (0.10%) per year until it reaches 4.99% provided the Governor’s revenue estimate, net revenue collection and Revenue Shortfall Reserve requirements are met.

- Increasing the Tax Year 2024 standard deduction to $12,000 (for Single, HoH, MFS taxpayers) and $24,000 (MFJ taxpayers).

- Giving each taxpayer the option to elect either the standard deduction or federal itemized deductions effective January 1, 2024.

- Granting each taxpayer who elects to itemize a $300 credit.

It is important to note that on December 4, 2023, Governor Kemp, Lieutenant Governor Burt Jones and House Speaker Jon Burns announced their shared priority of introducing and passing legislation to accelerate the flat tax rate decrease to 5.39% in Tax Year 2024 (rather than the 5.49%), which would be a cut of 36 basis points from the Tax Year 2023 top bracket rate of 5.75%.

We will continue to follow this and provide updates as the regular session of the Georgia General Assembly unfolds this year. And, as always, we at Capital Investment Advisors strongly recommend collaborating with a trusted qualified financial advisor and/or tax professional to discuss how the new state tax law applies to your specific situation.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.