On June 18, 2025, SmartAsset Named Capital Investment Advisors One of the Top 10 Financial Advisor Firms in Atlanta

Capital Investment Advisors is proud to announce that SmartAsset has named Capital Investment Advisors, LLC as one of the top 10 Financial Advisor Firms in Atlanta, Georgia on June 18, 2025, based on current publicly available data. SmartAsset’s financial experts vetted all registered investment advisors (RIAs) in Atlanta to find the top firms. Please see […]

Client Spotlight: From Boardrooms to Bookshelves: How Gerald Turned Retirement into a Creative Renaissance

A native Georgian who grew up in the Atlanta suburb of Decatur, Gerald received a BBA from the University of Georgia (Go Dawgs!) and then signed up for three years of service as an artillery officer in the U.S. Marine Corps. Along the way, he achieved his MBA from the University of Tampa and went to work for companies such as Coca-Cola Enterprises and Genuine Parts Company.

Capital Investment Advisors Named to InvestmentNews’ 2025 List of Top Financial Advisor Teams in the USA

ATLANTA – May 23, 2025 – Capital Investment Advisors is proud to announce that it has been recognized as one of InvestmentNews’ “Top Independent HNW Teams of 2025” and was among 20 firms chosen in the Southeast Region. According to InvestmentNews, the selection process relies solely on objective, independent data such as: SEC filings: Evaluated […]

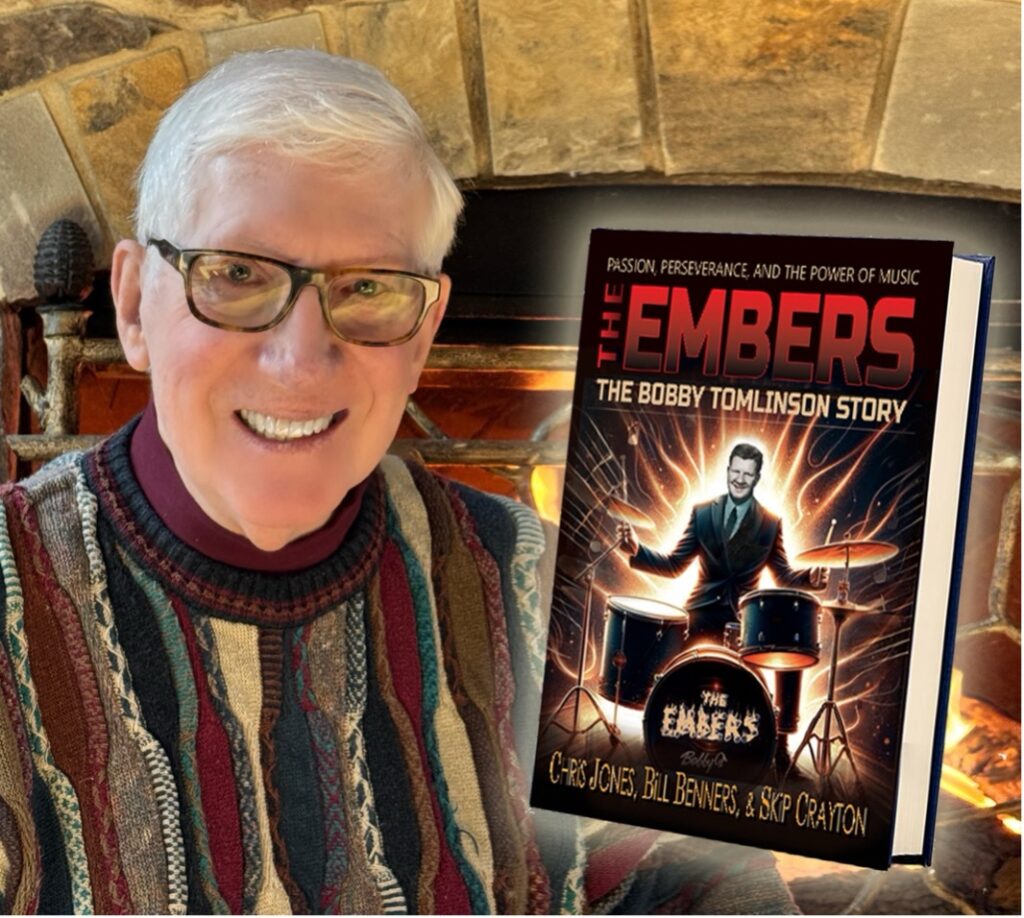

Client Spotlight: Writing, Retirement, and Southern Soul – The Inspiring Encore of Chris Jones

If you cross-checked Capital Investment Advisors’ client list with a roster of extraordinary citizens who stand out in their respective communities, there would be plenty of overlap. Today’s spotlight shines on one such happy retiree—Chris Jones. Born in Alma, the blueberry capital of Georgia, his first job was as a high school radio DJ, which led to a stint as a news and sports reporter. In what he now refers to as a forty-year detour, he spent most of his career in corporate public affairs. Retiring from that world of politics and legislation in 2015 finally freed him up to rediscover his journalistic roots.

Client Spotlight: Kyle & Russ’s Month-Long Adventure Out West

Our job is to help retirees find happiness. When they do, we celebrate the news to help inspire others to pursue their core pursuits. Today, the spotlight is on Kyle and Russ.

Kyle is a retired English professor. Russ mostly retired from IT management and Process Improvement in 2016 but maintains a small portfolio of consulting work to minimize nest egg withdrawals. With their newfound freedom, they decided to hop in a convertible Mustang and head west for a month-long, unforgettable road trip to visit family in the West Coast and complete the California Coast Highway.

Wes Moss featured in Atlanta Magazine’s 2025 Atlanta 500: Professionals

Recently Wes Moss was featured in Atlanta Magazine’s 2025 Atlanta 500: Professionals list for hosting Money Matters. Here’s what Wes had to say when asked why he chose this work: “When I was growing up, my dad was a large-animal vet. After going with him on a 5 a.m. farm call, I decided there was […]

Client Spotlight: To Iceland And Beyond

Retirement often marks the end of a career, but for Jerry and his wife Cherie, it was the beginning of something extraordinary—a chance to turn their lifelong dreams into unforgettable experiences. From dogsledding in Norway, chasing Atlantic puffins under Iceland’s misty skies to marveling at wild bears in the heart of Mount Rainier, their adventures remind us all that retirement is not only a retreat but a launchpad.

Capital Investment Advisors Promotes Four to Partner

ATLANTA – February 12, 2025 – Capital Investment Advisors, a $6+ Billion Atlanta-based RIA firm, announced today that it has promoted Amanda Lewis, Connor Miller, Joel Dean, and Dan Abramowitz to partner. Partnership was offered to these team members based on merit and a consistent, demonstrated commitment to the firm’s mission to help families retire […]

Client Spotlight: Dallas And Lisa’s Cherished Italian Adventure

Lisa retired from the Bell System in 2006 and Dallas a year later, timing that was influenced by an early package offer after the “new” AT&T bought out the company. No longer tied to their desks, they jumped at an invitation from their daughter Candice for an Italian adventure. Candice and her husband Collins had honeymooned there nearly 20 years prior and had always wanted to return with Dallas and Lisa.

Client Spotlight: A New Chapter of Service for These Happy Retirees

Retiring after a successful career as a chemical coating sales representative and over 30 years in healthcare management, Lloyd and Vickie were ready to get started on their core pursuits: community service and leadership. The two moved to Lake Oconee near Greensboro, Georgia. Wasting no time, Lloyd became Homeowners Association (HOA) President of their new community and then joined the Greene County Volunteer Fire Department, where he spent a decade ensuring the safety and well-being of his neighbors.