The Federal Reserve (The Fed) spends endless hours worrying about inflation, and analysts on Wall Street spend just as much time reacting to whatever actions the Fed takes. Regular folks on Main Street might not have their eyes glued to actual inflation figures, but they do closely scrutinize the prices they see all around them. For them, the question is less about when rates will return to 1, 2, or 3 percent, but when will the cost of groceries or gasoline stop eating away at their family budget?

If we can get the inflation rate under control, as many recent signs suggest is starting to occur, what happens next? Those who follow the news closely know that many in the financial world, including some at the Fed, are predicting the likelihood of a recession.

If it sounds like doom and gloom, don’t fret. As investors, we have permission to ignore economic forecasts. Permission from whom, you might ask? From the Oracle of Omaha himself, Warren Buffett. As referrals go, it doesn’t get much better.

“I don’t pay any attention to what economists say, frankly,” Buffett once said in a CNBC interview. “Well, think about it. You have all these economists with 160 IQs that spend their life studying it, can you name me one super-wealthy economist that’s ever made money out of securities? No.” He went on to add, “If you look at the whole history of [economists], they don’t make a lot of money buying and selling stocks, but people who buy and sell stocks listen to them. I have a little trouble with that.”

He didn’t become the chairman and CEO of Berkshire Hathaway and one of the wealthiest people in the world by not knowing how to invest, so whenever he speaks, I tend to listen. In this case, one of the words he used stood out to me — history.

Making money is hard, so it’s not surprising that once people have invested that hard-earned cash into retirement accounts, they feel highly anxious about stock market volatility. Anxiety is part of the human experience. It’s what kept our ancestors safe from danger. You can’t eradicate it, but you can learn to tame its adverse effects. While we can’t always look at the past to predict the future, we can use history as our guide. Zooming out to look at market history as a guide can be an effective strategy to help tune out scary economic forecasts.

The dream of a perfect investment plan is just that — a dream. People do win the lottery, but if it were a common occurrence, it wouldn’t be the lottery! If you allow a perfect plan to become the enemy of a good one, you’ll most likely regret it. Instead of focusing on the right time to get in, focus on how costly it can be to get out. The math behind the power of remaining fully invested is stunningly clear, and trusting the consistent trends that the statistics show is vital to long-term success as an investor.

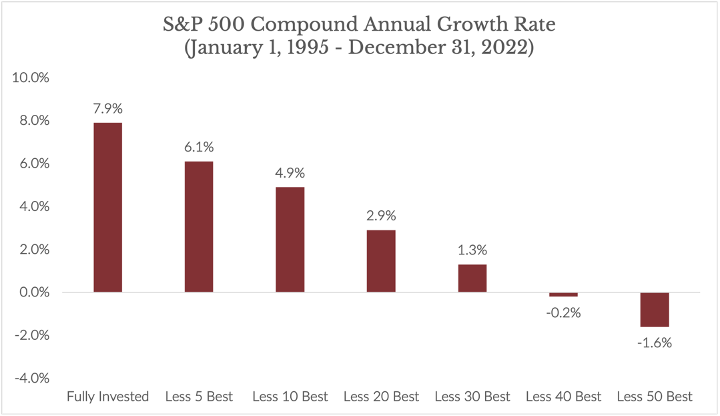

I asked my research team to pull market timing data as evidence. The results show how damaging it can be to flee when times are tough.

Source: Strategas; Capital Investment Advisors

Looking back at the S&P 500 annual growth rate of return from January 1995 through December 31 of 2022 gives us nearly thirty years to study. The tumult of multiple bear markets and recessions still produced an average total annual rate of return of about 7.9 percent.

But what if an investor missed just a few of the best days in the market over that colossal period? Missing the five best ones cuts the rate of return from about 7.9 percent to 6.1 percent. Still a respectable number, but that’s a 23 percent reduction compared to the total per-year return you would have received if you had stayed fully invested. All because an investor got nervous and pulled money out for five trading days!

Bumping it up to missing the best ten days drops the rate of return down to 4.9 percent — a 38 percent decline. Missing the best twenty trading days lowers the overall return by 63 percent, bringing it down to 2.9 percent. Depressing, right?

At thirty days, the rate of return falls to 1.3 percent. Try forty days or fifty days. Now it’s in negative territory.

As you can see, just a snippet of time on the sidelines can lead to a bounty of missed opportunities. If your strategy is to enter and exit the market according to declines and rebounds, you can be asking for a world of dramatic, fretful moments.

And to borrow another quote from Mr. Buffett which I think is helpful these days for investors, he once said, “we will continue to ignore political and economic forecasts which are an expensive distraction for many investors and businessmen.”

The bottom line is that most investors are rewarded for staying invested in the stock market. It is often beneficial to remain invested in reliable, high-quality companies, diversify, remain calm, and practice self-control over substantial stretches. Economic forecasting makes for good headlines but oftentimes, retirees past, present, and future would be well served to ignore them when making investment decisions. When you find yourself drifting back toward the pull of the financial fortune tellers, remember the words of Warren Buffett, “If I depended in my life on economic forecasts, I don’t think I’d make any money.”

That is good enough for me. How about you?

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. For stocks paying dividends, dividends are not guaranteed, and can increase, decrease, or be eliminated without notice. Fixed-income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed-income securities falls. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions,