No retirement plan is complete without considering Social Security benefits. The biggest decision retirees have when planning around this monthly check is when to enroll.

As with most questions in life, the answer is, it depends.

Sure, it can be tempting to cash in as soon as you’re eligible – for most people, that’s age 62. And why not? After all, you’ve been paying into the system for much of your working life, and the guaranteed monthly income is nice to have.

But that can be a costly move, and retirees should look closely at their particular financial situation before jumping in. There are distinct advantages associated with both taking Social Security benefits as soon as you can, and waiting until later to claim.

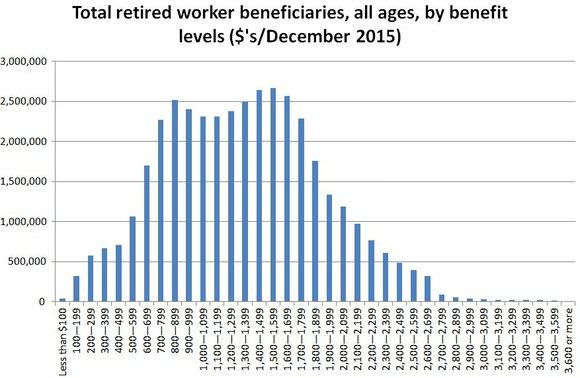

Social Security provides a financial safety net to millions of retirees, but the amount of each recipient’s benefit depends on a complex calculation that adjusts 35 years of monthly income into today’s dollars. For your specific projected payment, log in to the Social Security Administration’s (SSA) website. Most folks will receive a benefit of somewhere between $800 and $1,800 per month according to the chart below. Knowing your benefit’s dollar amount at certain ages is the first step in making an informed decision about when to claim your Social Security.

One important fact to remember about your Social Security benefit is that it isn’t designed to keep you at the income level you had when you were working. Rather, the benefit provides the average person with about 40% of their pre-retirement pay in benefits. To put this figure into perspective, the average retired worker is collecting just $1,360 per month in Social Security income in 2017.

So, Social Security alone doesn’t necessarily guarantee financial security in your retirement. But according to the SSA, 21% of married couples and 43% of single retirees rely on their monthly benefit for 90% of their annual income. That’s a big chunk of the population. Whether your Social Security check will be supplemental or sustenance for your financial well-being, it’s a good idea to run the numbers and think about how to make the program work for you.

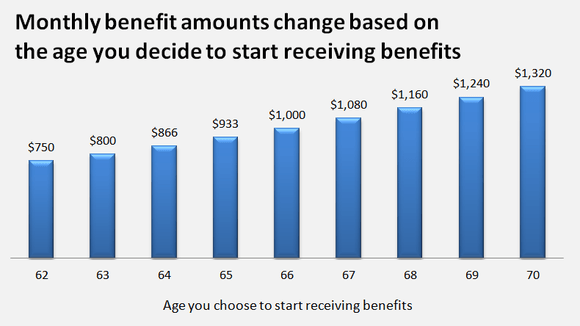

Consider this: if you start taking Social Security at age 62, rather than waiting until your full retirement age (FRA), you can expect up to a 25% reduction in monthly benefits. The SSA only pays out 100% of your benefit if you claim at your full retirement age. These days, FRA is no longer age 65; it ranges from 66 to 67, depending on the month and year in which you were born. And your annual cost-of-living adjustment (COLA) is based on your benefit. So if you begin Social Security at 62, you start with reduced benefits, meaning that your COLA will be lower over the years too.

Alternatively, waiting to claim benefits until after you reach your full retirement age means more money monthly. The SSA rewards those who wait to claim with delayed retirement credits for every month they put off claiming; your benefit grows by about 8% annually for every year you delay claiming until you reach age 70. For instance, a person with an FRA of 66 who claims at age 70 can receive 132% of their initial FRA benefit.

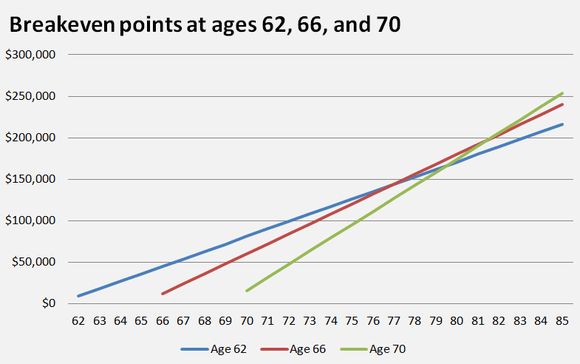

At first glance, this extra amount for waiting to claim until age 70 appears to make the wait worth it. However, a key point to remember is the amount paid out in benefits over a lifetime is calculated to be the same, regardless of what age you are when you claim. By delaying your claim until 70, you may produce bigger checks than if you had claimed early, but you’ll collect fewer checks over your lifetime.

If longevity is in your family tree, waiting could mean you to come out ahead. But assuming the average life expectancy, collecting more, smaller checks could be best, especially if you can invest some of the money. If you have ample income from other sources, it might make the most sense to embrace this claim-early-and-invest strategy.

Overall, the decision about when to claim your Social Security benefits should focus less on total lifetime benefit expectations than on personal matters. Someone who is healthy and enjoys their work might decide it’s smarter to wait to claim benefits so that they can pocket bigger checks. On the other hand, someone who is less healthy or needs to stop working might find it’s wisest to claim benefits at 62. Other key points to consider include the health of your spouse and your individual retirement goals.

The bottom line is that the decision about when to claim your Social Security benefits is one of the most complex, and important, choices you’ll face ahead of retirement. And there’s no one-size-fits-all approach in deciding when to collect. If you tailor your decision to your individual circumstances and account for life changes as well as financial changes, you’ll be well on the road to a happy retirement.

Charts courtesy of Motley Fool