In a recent article on The Entrepreneur Fund, author Scott Morgan compiles and analyzes financial advice from several popular retirement books including You Can Retire Sooner Than You Think by Wes Moss.

Here is an excerpt from what Morgan discovered.

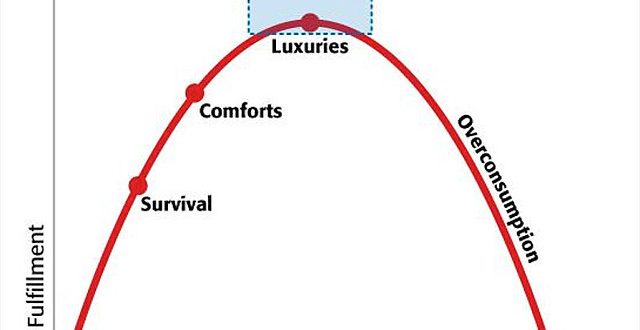

As many Get Rich Slowly readers have discovered over the years, the exercises and advice in Your Money or Your Life can transform your relationship with money, helping to break your dependency on Stuff. It’s a great book for learning how to align your spending with your values. It provides a roadmap to Financial Independence.

Where Your Money or Your Life is less good, however, is providing advice for what to do after you’ve reached this goal. What happens when you achieve Financial Independence? What happens when you have enough — and then some? Many people reach this place only to find themselves wondering, “What next?” It’s an important question, one that’s often tough to answer.

When you’re building your wealth snowball, your goals and mission keep you focused on the future. They guide you toward the things you ought to do while helping you avoid temptation and peril. Without a clear purpose, it’s difficult to stay on course during the long march to financial freedom.

Purpose is also important after you’ve obtained the wealth you desire.

In his book You Can Retire Sooner Than You Think, financial planner Wes Moss shares five “secrets” of a happy retirement. After surveying 1350 retirees across 46 states, Moss found that the number-one predictor of contentment is a sense of purpose.

“[Happy retirees] have a well-defined understanding of their purpose in life,” he writes. According to his research:

- 91% of happy retirees are clear and comfortable with their sense of purpose.

- In contrast, 89% of unhappy retirees report that they’re uncomfortable (or only “slightly” comfortable) with their sense of purpose.

The bottom line: “Happy retirees know what their retirement money is for.”

To that end, Moss encourages his clients (and readers) to foster a handful of “core pursuits” — activities that excite them and bring them joy. By developing these core pursuits before reaching retirement or Financial Independence, you’re better prepared for what comes next.

Similarly, in Choose Your Retirement, Emily Guy Birken writes that “a retirement based on values will be a fulfilling and contented experience”. Birken dubs this a “values-driven retirement”.

A values-driven retirement sounds great. But how do you discover your values? How do you pick your core pursuits? How do you decide what you want out of life? How do you answer the question, “What next?” I believe the answer goes back to creating (an adhering to) a personal mission statement.

With a mission statement, you have a roadmap to meaning. Without one, you run the risk of finding yourself lost in the woods where even your wealth won’t help you find the way home.

Click here to read the full article and complete a powerful exercise to help you discover your true purpose.

This article is being reproduced and made available with the permission of The Entrepreneur Fund. The article was written and produced by The Entrepreneur Fund. This information is provided to you as a resource for informational purposes only and should not be viewed as investment advice or recommendations. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. An investor should always consult their investment professional to determine what is suitable for their specific situation. Investment decisions should not be made based on information contained in this article. The information contained in the article is strictly an opinion and for informational purposes only and it is not known whether the strategies will be successful.