I’ve been doing some form of financial radio for more than fifteen years. In the book Outliers: The Story of Success, author Malcolm Gladwell stated that it takes about ten thousand hours of practice to become an expert in any given field. I don’t consider myself a radio expert, but I do feel incredibly grateful to have had the chance to connect with so many listeners. There’s nothing like having someone call into the show with a reaction to a topic.

Now that our podcast has built a following we set up a Retire Sooner hotline (800-805-6301) so listeners could leave a voicemail with any burning questions. We’ve also got a Facebook group where followers can comment. We figure that if one person speaks up, that probably means others have similar concerns. When a diesel truck with a “How Am I Driving?” bumper sticker cuts you off in traffic, you may not call the 800 number to report the incident, but you’re hoping someone else will.

All this to say, we want to know what’s on your mind. Today, I’m dedicating some time to make good on that aim.

The first voicemail comes from Chris.

As a long-time listener who has applied your principles and thoughts and has now been successfully retired for a couple of years, it dawned on me that perhaps, occasionally, you could aim your shows at that audience. Because the people who have been with you a while have already gone across one line, and now we’re working towards the next line in our life. And any advice you could give on how to successfully handle your funding and that stage of life, that kind of thing, I think would be really helpful.

What I love about this question is how Chris describes going from one line to the next. It helps me visualize the separate phases of financial life. The first one is centered around accumulation. Ryan Doolittle, the host of our Happiest Retirees podcast, calls it the soufflé model because it’s all about watching our savings rise. Only in the second phase—distribution—do we allow ourselves to enjoy a delicious bite. Chris is worried about taking too many bites and ending up with an empty dessert plate. How do we add more egg whites to give that soufflé a little more lift?

One of the first defensive strategies for someone in their post-career distribution phase is the investing they’ve done along the way. Investing in a highly diversified set of U.S. companies and giving them time to grow and appreciate will usually help fund a portion of our retirement. It’s true that, over time, the market can inevitably be up and down. We can’t control that, but what can be incredibly helpful is the consistent income that we get from dividends, interest, and distributions.

When you’re younger and still in the accumulation phase, you don’t typically think of the dividends because they should be set to automatically reinvest. Once the career slows down and the paycheck dwindles, you can distribute that dividend to yourself and allow yourself to take in some in income. Furthermore, you can adjust your investments to focus on the sectors (energy, utilities, consumer staples, etc.) that pay higher dividend percentages. That way, you’re creating more income streams to plug the hole left by the missing paycheck. There’s typically a happy medium in terms of dividend percentage. Going too high can often prove unsustainable but shooting for something between 2 and 4 percent can be effective for many. And in today’s high-interest environment, we can sometimes get even higher rates on our government and municipal bonds. All that income together can go a long way in getting us to our annual spending goals.

Imagine if your portfolio was yielding, in aggregate, 3 to 3.5 percent. Right away, we’re close to satisfying the 4 Percent Plus Rule. As a reminder, that well-researched rule of thumb, discovered by William Bengen, found that retirees who draw between 4 and 4.5 percent of their portfolio in their first year of retirement and adjust every year for inflation should likely see their money outlive them. (This scenario assumes a 50-75 percent allocation in stocks.)

One final note for Chris—when planning the social aspect of your retirement and figuring out what core pursuits interest you, there’s no pressure to compare your choices to anyone else. All you have to do is pick three or four activities you love doing. That’s it! That will increase your socialization and add structure to your week. One of these core pursuits could even be a part-time job that pays, thus creating another income stream and killing two birds with one stone.

Put this all together, and it makes sense to think of retirement planning in phases. We start in the accumulation phase, then cross the line over to a retirement grey zone where we still want to work a little, and then we cross another line to the phase with no wage income or business profits.

Chris, thank you for this great question. The next one comes from Tripp.

I’ve got a rental income property that’s paid for, and I’m in the process of building another house. I heard you tell Jared Yamamoto [Radio Producer] that if he were to buy another house, he should always keep his condo because it keeps up with inflation. But my question is, if I don’t have a mortgage and interest rates are 7 percent right now, doesn’t that mean that I’m saving 7 percent each year that I would’ve had a mortgage?

What Tripp is asking makes a lot of sense. He’s wondering if it’s best to sell the old place and put the cash toward the new one to eliminate or lower the money that will go toward a higher interest rate on the mortgage. First, yes, that would be a productive strategy, and I’m not opposed to it. But on the flip side, selling the old property means he’s losing out on its low interest rate and on the rental income on a property that will hopefully continue to appreciate over time.

Keeping the old property and financing a new one is a riskier move but has the potential for more significant gains as both could help you keep up with inflation over time. The pitfalls are worth considering: tenant behavior, the housing market softening, and ending up with too many bills to pay. You don’t want to stretch your income too far relative to the debt that you need to service. But rather than the conventional strategy of selling a house to buy another, there is something to be said about holding on to the gift that is a low mortgage rate. If you can pull it off, over time, you might find yourself owning a few separate properties, with a couple of them paying you income. That’s a significant boost in your retirement.

Our research shows that retirees within five years of paying off their mortgage are four times more likely to end up in the happy group. Because of that, I advocate not having a mortgage on your primary house at that stage. But, if you have some debt on a cash-flowing, income-producing property that is well on its way to eventually being paid off, it can make sense to keep that. Leveraging more financial assets can be a powerful way to protect our purchasing power over time.

Thanks, Tripp. The final question comes from our Retire Sooner Facebook group. Jeff asks:

I’m close to an earlier retirement (58), and I am quite frustrated with the “safety” of my bond index funds. Is there value or a right decision path to move from bond funds to actual bonds? They appear to be more predictable (you know what you will get).

Great question, Jeff. This scenario most likely applies to a large portion of our audience. Suppose you own a bond fund, and exchange traded fund (ETF), individual bonds, or a balanced fund (60 percent stocks, 40 percent bonds). In that case, you’re wondering what happened to the remarkable stability of the bond portion of your portfolio. It’s been an extremely challenging bond market for the past three years or so because of the inverse relationship between bonds and interest rates.

We had several decades of interest rates trickling lower, which was suitable for higher bond prices. Rates eventually got to zero and then bungee corded back to reality—they seem overly high to us now but are in line with long-term historical trends. That round trip back to reality has made for a challenging bond environment. The aggregate bond index shows a line that continues to descend. There’s no foreseeable reason for this to change until interest rates cease to rise.

This tumult is why bondholders feel like the value has been dropping. The silver lining is that they’ve seen some interest income, but their values have weakened. That said, even a few years of bond turmoil is mild compared to the volatility we see in the stock market.

Jeff inquires about individual bonds. The positive aspect of those is knowing the destination when you purchase them. But, even when they have five-, seven-, or ten-year horizons until you reach maturity, you could see some price fluctuations heading lower.

Remember, bonds equate to buying IOUs from a government, municipality, or company. In exchange for your money now, they agree to pay interest until the end of the term, at which point you should get all of your original money back. Bond funds are a little more complex, but with individual bonds, you know what year, month, and day you’ll get your money. That gives you predictability but doesn’t mean you won’t see vacillation on your statement.

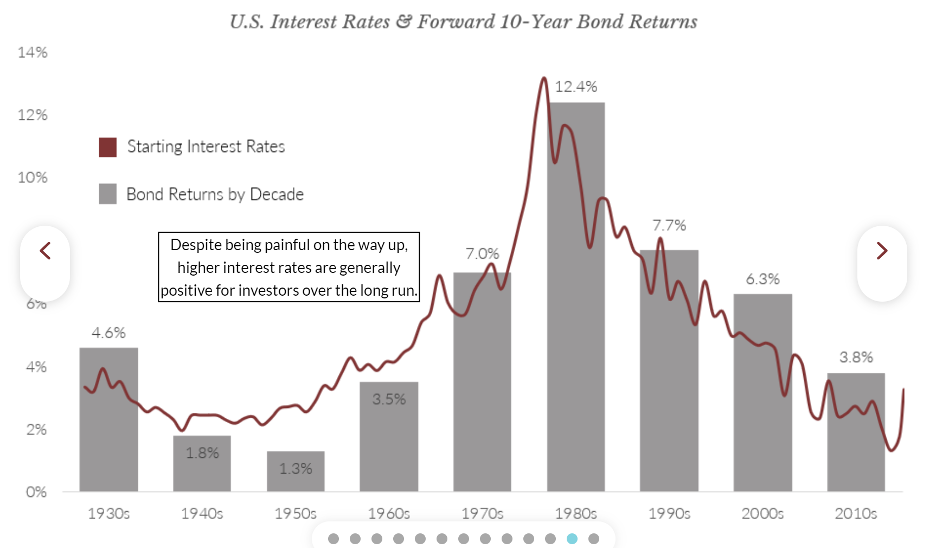

There’s been a real headwind for any bond vehicle over the last few years. The good news is that future bond returns over the next few years, or longer, are highly correlated to where interest rates begin. In other words, bond yields today predicate overall bond returns tomorrow. In the bond world, people like to say “yield is destiny” because starting yields are a pretty darn good indicator of how bonds will do over time. If you buy any sort of bond when prevailing interest rates are locked in at 5 percent, you’re highly likely to make about 5 percent year after year for the next several years.

Another method combines a couple of the aspects Jeff is looking for—you can buy bond ETFs with specific maturity dates. That allows you to buy more than an individual bond with the peace of mind of knowing that they all mature on a particular date. Jeff might want to consider that option if he wants the best of both worlds.

If you’ve been a heavy bond investor, it’s been tough sledding, but the snow underneath that sled will probably get smoother over the next few years.

Source: Bloomberg

Thanks again to everyone who called or wrote in with questions. Please keep them coming! We love hearing from you and always do our best to answer. Even if we can’t do it here, on Money Matters, or the Retire Sooner podcast, we’ll usually find a way.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.