Investing is an endeavor of patience and perspective, two virtues not shared by the hurried world. The twenty-four-hour news cycle, social media, and smartphones ensure a steady bombardment of headlines constantly screaming for our attention. That’s why it can be a valuable exercise to take a deep breath, zoom out, and visualize the big picture. The daily market drama makes more noise, but slow-developing macro trends often shape the future. Knowledge and context, rather than today’s breaking news, might be just what the doctor ordered to process these past few volatile years and make productive investment decisions.

The topic reminds me of a favorite Warren Buffett quote: “The stock market is a device for transferring money from the impatient to the patient.” As few others can, Buffett’s incisive humor explains the reality better than a long-winded research paper ever could.

There’s only one Warren Buffett, but with a promise to be concise in my analysis, here are three common oversights that I think everyone ought to know about the market.

1. The Stock Market Has Been Virtually Flat Over the Last Two Years.

Even with the S&P 500 up approximately 14 percent this year (as of September 22, 2023), the major averages have not made any ground dating back to September 2021. Moreover, a traditional 60/40 portfolio of stocks and bonds is down more than 5 percent over the same period.

Whether comparing dividend stocks vs. non-dividend stocks or the Dow vs. the S&P 500, the endpoint has been nearly identical over the last two years. The difference is the path each took to get where we are today.

Companies with a track record of growing dividends over time experienced calmer seas than the broader market. Whereas the S&P 500 and NASDAQ 100 were down about 20 and 30 percent, respectively, between September 2021 and the October 2022 nadir, dividend investors required much less Dramamine to settle any seasickness. Though theirs was not all smooth sailing, being down less than 13 percent over the same stretch indeed charts a more pleasant voyage.[1]

[1] Using the Morningstar U.S. Dividend Growth Index, which seeks to track the investment results of U.S. equities with a history of consistently growing dividends as a proxy for dividend investors.

Source: YCharts, CIA Calculations as of September 22, 2023

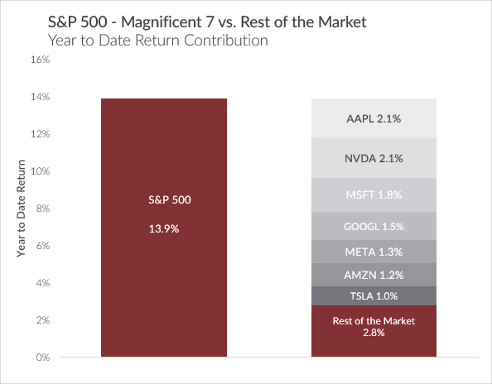

2. Seven Stocks Have Accounted for Nearly 80 Percent of the S&P 500’s 2023 Gain.

Until now, 2023’s market has not necessarily been representative of the average stocks residing within it. That is to say, though 2023 has objectively outperformed 2022, the barrage of headlines about the meteoric rise of a few AI emergent tech stocks can chip away at our patience. Why should they have all the fun?

While it’s true the basket of stocks in the S&P 500 is registering a sizable gain, that exciting news hides what lies beneath the shiny apples on top of the bushel.

You may or may not have heard of the “Magnificent Seven.” Not the 1960 motion picture starring Yul Brynner and Steve McQueen, but the phrase coined to describe the seven best-performing companies of 2023. These seven stocks have accounted for over 80 percent of the S&P 500’s 2023 gain. In sharp contrast, the average stock—the other four hundred and ninety-three are up less than 3%.

This return feels more than acceptable on the heels of last year’s dismal performance. But in truth, it’s still more tortoise than hare.

Source: Bloomberg, CIA Calculations as of September 22, 2023

Though tempting, it doesn’t serve us to view 2023 in a vacuum. Adding the context of 2022’s characteristics drastically changes the overall dynamic. Despite the Magnificent Seven stocks nearly doubling this year, they are flat since the start of 2022. Only two have a higher share price than they did at the beginning of last year.

This indicator points us back to the sound philosophy of diversification—the many investment styles working together over time if given a chance. Growth, value, dividend payers, and non-dividend payers all have the potential to generate acceptable returns over long periods. My predilection for income investing is not about right or wrong; it’s because I tend to favor allocating to quality companies at reasonable valuations. Sure, there are others with faster growth capacity, but that often comes with higher volatility and little to no income. For those striving to provide consistent cash flow for reinvestment or expenditure, that’s not necessarily the most ideal avenue.

This leads us to my final and most significant point, which could be excellent news for income investors.

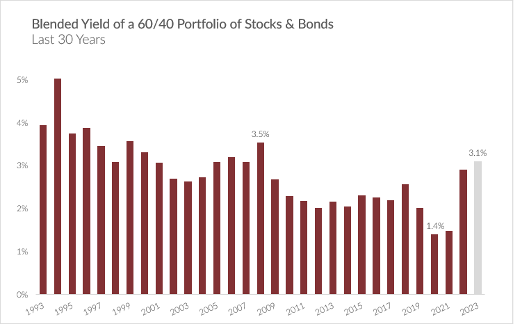

3. A Balanced Portfolio Yields More Than it Has in About Fifteen Years.

Wall Street and Main Street have both felt the harsh effects of the Fed’s interest-rate-hiking campaign against inflation, but a happy byproduct has been the resurgence of fixed income as a proper complement to stocks. Compared to the previous decade, which saw bonds paying a 2.5 percent average yield, today that figure could be twice as high, with some U.S. short-term treasuries yielding nearly 5.5 percent.

Nothing is guaranteed, but this trend could bode well for the income-investing environment. A traditional portfolio of 60 percent stocks and 40 percent bonds yields more than 3 percent for the first time since 2008. To put that in perspective, the average yield from 2010 to 2021 was just 2 percent! This translates to an outcome that is possibly 50 percent higher than what investors were accustomed to over the last decade. What’s more, that only accounts for general market for stocks, whereas a focus on dividend-paying ones can sometimes pay 3, 4, or even 5 percent.

Source: Bloomberg, CIA Calculations as of September 22, 2023

Bottom Line

These three common oversights are critical to comprehend because they provide context for this year’s market action and re-direct our attention to what may be the most essential takeaway strategy: long-term investing in quality companies at reasonable values that pay income.

Furthermore, comprehensively digesting these lessons allows us to highlight that after a decade-plus of suppressed yields, we’ve entered a period that generates substantially more income from portfolios. In an uncertain world, income investors can feel a sense of confidence that patient, sound decisions with their balanced portfolio of quality investments can help them accomplish their long-term income goals.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.