2022 has been a rough year for investors. Nearly every corner of the market is in the red — stocks, bonds, commodities, and even gold. It’s reasonable to expect that people are searching for a way to shelter from the storm by pulling money out of the market.

Logical decision-making serves us well in most life situations. For example, even on game night with my family, I’ve found that calm, deductive reasoning can help me edge out my wife’s trivial pursuit team when it counts. And if you don’t think that’s a high-stress environment, you don’t know my wife!

Why, then, is logic the wrong way to go when timing your investments?

The answer is that logic doesn’t fuel the market. Sure, it might be part of the chemical compound, but that high-octane formula has all sorts of other, flammable ingredients like adrenaline, emotion, and unpredictability. Thinking you can side-step a few market downturns to increase your chances of stock profits often means you could miss out on the best parts of the market recovery.

Imagine showing up thirty seconds before a surprise party starts because you want more time to relax at home. Hypothetically, it should work as long as you get there before the birthday girl, right? But who knows! You might hit one extra red light on the drive over and ruin the surprise. Isn’t it wiser to arrive a little early, even if it means suffering through some pre-party small talk?

Likewise, time in the market is generally more important than timing the market. Write that down and remember it. Market recoveries can come fast and furious and missing a handful of those big upswings can put giant dents in your overall returns.

How violent are market recoveries once they occur? On average, the market recovers 30 percent in the first thirty days of that movement. Sure, the entire process is more gradual, but the first fraction of that recovery time, on average, makes the difference.

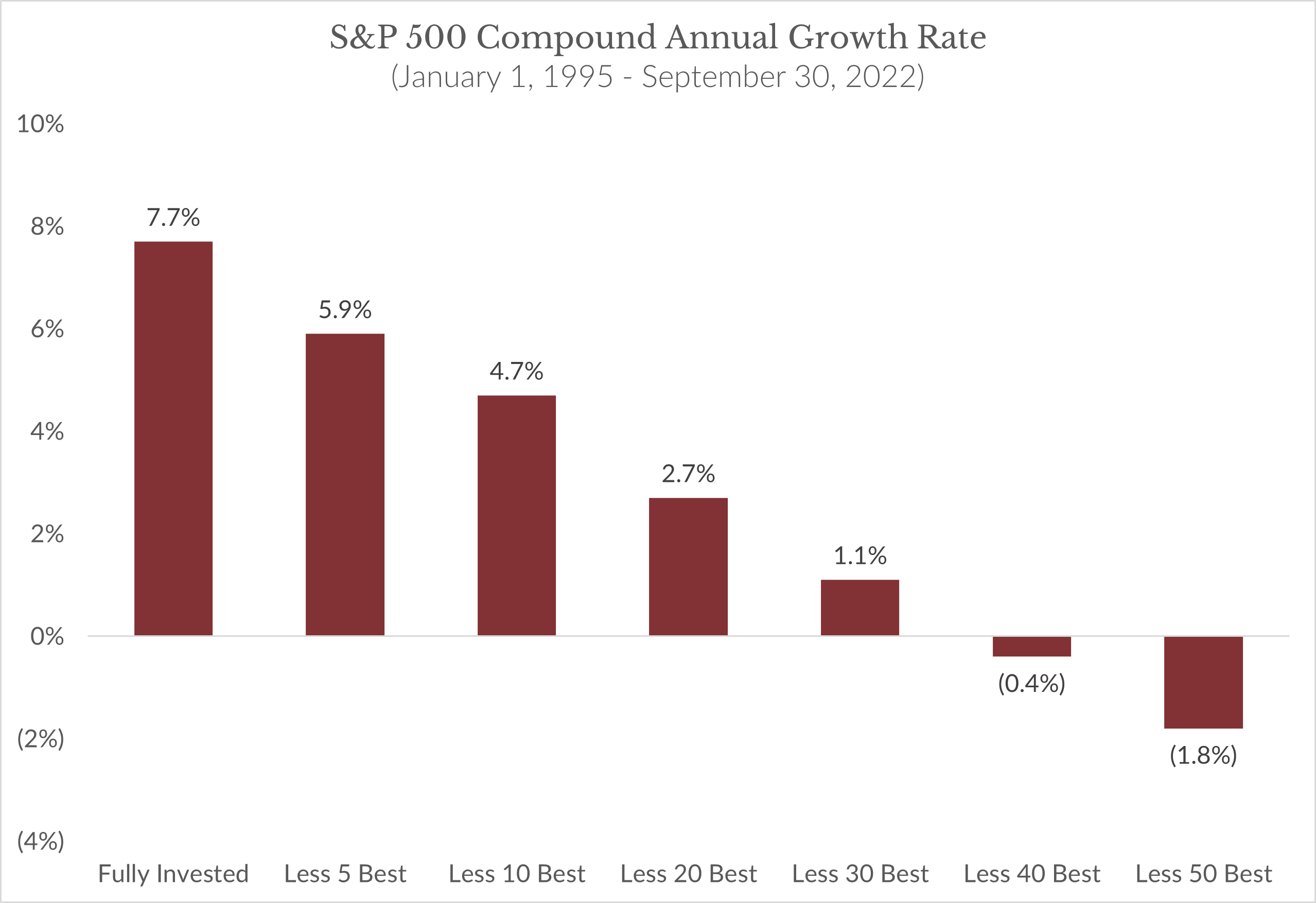

Need some proof? I don’t blame you. Data is king. Let’s look at some examples of investors staying invested vs. missing out on just a few of the best up days over time.

Source: Strategas, Capital Investment Advisors

Looking back at data from 1995 through Sept 30, 2022, gives us almost twenty-eight years, or 6,993 trading days. If you had stayed fully invested in the market (as measured by the S&P 500), your compound annual growth rate sits at 7.7 percent. That means you made 7.7% each year, and at that rate, in general, your money typically doubles about every nine years based upon an investment in the S&P 500. Well, what if you missed the best five days out of those 28 years? That’s only less than one-tenth of one percent of trading days! But the impact is devastating. Your return drops to 5.9 percent, or 23 percent lower annual return than it would’ve been if you had left your money in the market.

Don’t worry; it gets worse. If you missed the best ten market days, your return falls to 4.7 percent, roughly 40 percent lower. Miss the best thirty days, which is still less than one-half of one percent of those 6,993 trading days, and your return drops to 1.1 percent — 85 percent lower than what you would’ve enjoyed had you stayed fully invested.

We all know how easy it would be to accidentally miss thirty days, let alone five, over twenty-eight years. A few vacations here, some sick days there, and pretty soon, we’re in trouble.

No one can predict the future, but history gives us insight and perspective. It’s simply too difficult to precisely predict the peaks and valleys of the stock market. The odds say that, in general, the smart move is to stay invested with a good, solid allocation, even during market volatility.

Need more evidence? No problem. Bank of America recently published a study that looks at each decade’s market returns from the 1930s through 2020.

Examining the 1950s, we see that a fully invested portfolio in the S&P 500 returned slightly over 250 percent. Folks who missed the best ten days of the decade saw their returns drop to 167 percent. That means they fell by more than one-third! In the 1980s, a fully invested return was 227 percent. Missing the best ten days dropped it to 108 percent — 52 percent less.

“That’s all well and good,” you might be saying, “but what did the numbers look like in a bad market decade?” Well, it works even then. Consider the early 2000s. A fully invested portfolio in the S&P 500 decreased 24 percent, but if you missed the best ten days, your loss tripled to 62 percent.

Let’s take it another step. The same Bank of America study calculated that the total compounded price return from 1930 through 2020 was 17,715 percent. Read that again! That sounds insanely high but remember that we are talking about almost a century. If we take out the best ten days in each decade, that massive price gain falls down to 28 percent. That’s a 99.8 percent free fall! I get nightmares just thinking about it.

The moral of the story is that there’s no practical way to time the market. Did you ever play jump rope on the playground? Imagine that rope moving at the speed of light. Do you think you could jump in or out successfully?

The human brain is a risk aversion supercomputer designed to protect our survival at all costs, even when those costs add up to a large portion of our market returns. So, we have to fight against nature to avoid missing the rally because those rallies can make a huge difference in your overall portfolio performance.

Knowing and accepting this truth is vital, but it won’t always make it less painful to watch your investments suffer during a tough market. Are there any ways to make that part less tortuous? What I find helps my anxiety is to keep enough dry powder in safety assets (bonds/cash) to account for around three years of spending money in case times get tough. For example, if you decide you need $30,000 annually, so you put $300,000 into safety, dry powder categories. That allows you to invest the rest in longer-term oriented areas like stocks without losing as much sleep.

Even with their volatility, stocks can still be the most potentially lucrative investments, but only if you give them time to do what they do. If you’re forecasting one year, stocks aren’t always ideal, but if you’re looking ten or twenty years down the road, they can be hard to beat.

Am I saying that it’s impossible to time the market? No. Anything is possible. Maybe once upon a time, some obscure hedge fund managed to defy the odds and pull a rabbit out of a hat. But, as investors, we can’t rely on fairy tales.

2022 has indeed been one for the books. So, let’s use the reliable data from previous books to stay strong, disciplined, and positive about the market beyond just this year.

Listen to this discussion on the Retire Sooner Podcast!

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. There will be periods of performance fluctuations, including periods of negative returns and periods where dividends will not be paid. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.