If it feels like it’s been a painful year, it’s because it has been.

There’s no way to gloss over a turbulent 2022. Virtually every investment category is in the red. Growth stocks, value stocks, long-term bonds, short-term bonds, and even precious metals have all had significant pullbacks. This year’s early bright spot, energy/commodities, has fallen 20 percent since this summer. Put it all together, even balanced portfolios have had their worst year in nearly eighty years.

A great deal of this value eradication derives from a specific and dramatic change in policy by the U.S. Federal Reserve. In their crusade to combat inflation (Consumer Price Index (CPI) of over 9 percent this past summer), the Fed has launched one of the most momentous rate-hiking offensives in the past forty years. The Federal Funds Rate (FFR), which indirectly dictates borrowing costs around the nation, was near zero at the beginning of 2022. Today, markets are pricing in an FFR of over 4.5 percent by early 2023.

Despite the Gloomy Forecast, There Are Palpable Potential Silver Linings on the Horizon.

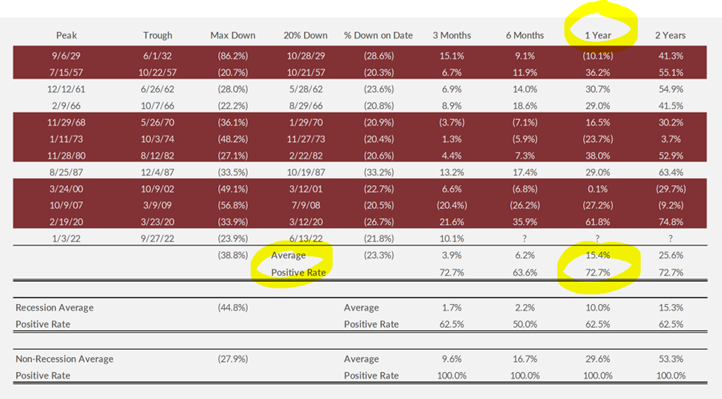

1. Stock Market Recoveries — Historically, once stocks drop 20 percent, there’s more than a 70 percent chance that they will reverse course over the following twelve months, with an average gain of 15 percent. Even during a recession, the markets demonstrate a two-thirds chance of being higher one year later. The past doesn’t predict the future but provides clues and hope. See the table below:

Source: CIA Research, Bloomberg data

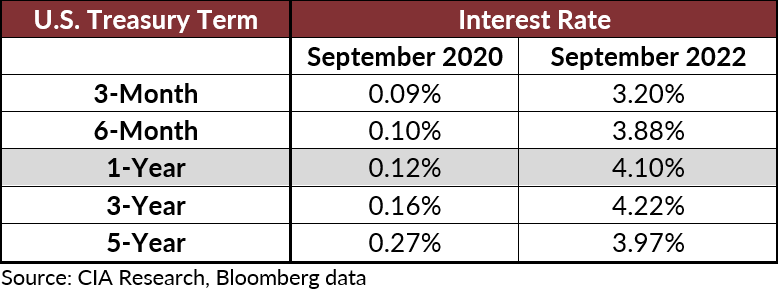

2. Bond Income Hits Fifteen-Year High — Many bonds currently pay more than 4 percent, the highest rate in the last fifteen years. While higher interest rates have been a headwind to fixed-income assets, it significantly improves bond income and overall returns moving forward.

Source: Bloomberg

3. Inflation Pressures May Already Be Easing — Once the Fed is confident that inflation is under control, global markets will likely breathe a sigh of relief. Its hawkish tone thus far in 2022 suggests there is more marathon yet to run, but we have begun to see some promising signs. In July 2022, the U.S. Case-Shiller Home Price Index declined by nearly half of one percent on a month-over-month basis: an annualized rate near -6 percent. A pleasant index surprise doesn’t mean that housing is cheap, but cooling prices for both homes and rent is welcome news. It could lead to lower CPI reports in the future, as housing accounts for roughly one-third of CPI.

Where Do We Go from Here? A Continued Focus on Income.

Seeing traffic clear up down the road doesn’t mean there won’t be any more speed bumps along the way, but I am encouraged by the signs. Keep these in mind:

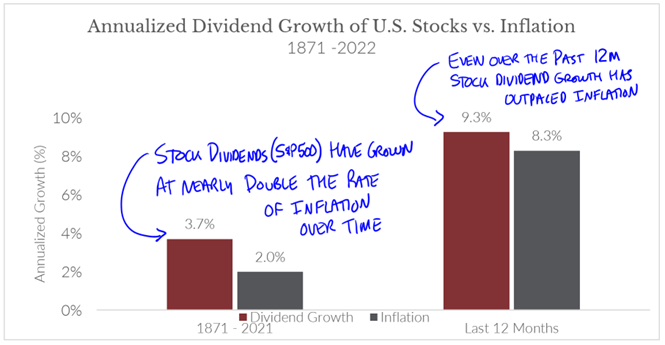

1. Dividends Continue to Rise. Stock dividends, which climbed at nearly twice the pace of inflation over the last 150 years (3.7 percent vs. 2 percent), have continued that ascent in 2022. While inflation was running amok at 8.3 percent, stock dividends managed to outpace it at 9.3 percent over this same period. It’s tough to find a better protector of purchasing power than rising dividends over time.

Source: Shiller Data Library, CIA Research, Bloomberg data

2. Bond Interest Rates Have Quickly Gone from Nothing to Something. Interest rates for Treasury bonds were near zero in September 2020. As of September 2022, many of these rates are approaching or exceeding 4 percent. The 1-Year Treasury Rate has increased a whopping thirty-four times its previous rate.

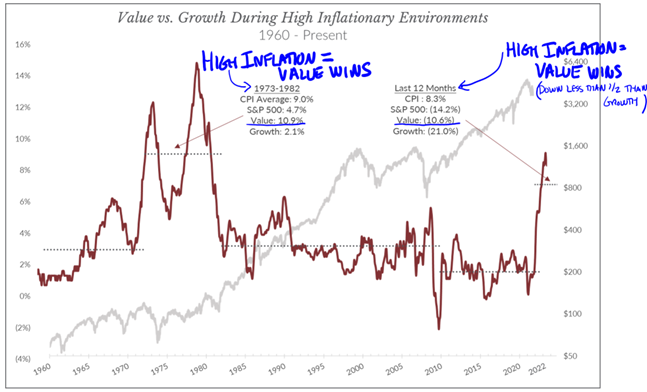

3. Value/Dividend Stocks Have Outperformed During Periods of Higher-Than-Normal Inflation. From a historical perspective, simply put, value/dividend stocks have generally outperformed during high inflation. 2022 is yet another example of this tendency.

Source: CIA Research, Bloomberg data

Bottom Line

When markets torture us with bad behavior, it is often the case that better days are around the corner. While it’s likely that pockets of excess persist in some areas of the stock market, it’s helpful to focus on companies and Exchange Traded Funds (ETFs) that have the potential to provide solid value over time with consistent dividend income.

From a bond perspective, rates moving from near zero to above 4% almost overnight can be a game changer for many retirees. As reluctant as I typically am to spotlight bonds, they are finally providing income levels decidedly helpful to retirement plans. One year ago, a $1 million bond portfolio would have typically yielded less than $10,000 in annual income. Today that could comfortably generate over $40,000.

Combine the new higher bond yields with the steadiness of quality dividend-paying stock dividends. Take a deep breath and remember that the U.S. economy knows how to take a punch. Stay ready for the next round. Time in the market is typically more important than timing the market, and as Rocky Balboa said, “It ain’t about how hard you hit. It’s about how hard you can get hit and keep moving forward . . . That’s how winning is done!”

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. There will be periods of performance fluctuations, including periods of negative returns and periods where dividends will not be paid. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.