Given the Middle Eastern events of the past few days and global tensions rising, we felt it would be useful to provide some dispassionate views on how Capital Investment Advisors think about times like these. A few caveats:

- The past is not indicative of the future. In other words, this time could always be different.

- We are not experts on Middle Eastern politics.

- War is horrible. Lives are at risk. We don’t want to talk about it. But … we’re sure it’s on the minds of many, so we feel it necessary to provide some context on what typically happens around events such as these.

Quick recap of the events that have taken place: the USA killed general Qassem Suleimani by way of a drone attack near the Baghdad International Airport following attacks on the American embassy in Baghdad. Iran retaliated by bombing two Iraqi airbases housing U.S. forces. As of now, there are no American casualties and Iran appears to be standing down. This is good. But, tensions are high and could be elevated at any moment. So, let’s provide our brief thoughts on how Capital views “war threat” type events. This will focus on the Middle East, but a similar logic would apply to a country like North Korea (as it did in 2017).

To make a long story short, here’s our viewpoint: events such as these typically cause short-term volatility (stocks, rates, oil, gold, etc.) but tend to be transient over time. Or even beneficial. With one giant caveat: a recession.

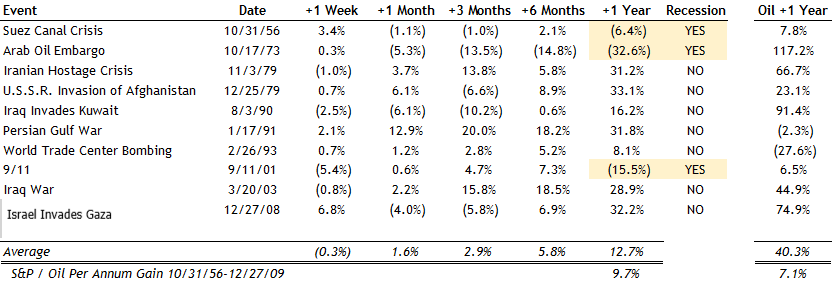

We went back and looked at the past 10 major Middle Eastern “conflicts” and proved this out. Over a 1 week period, stocks fell slightly at -0.3%. Sometimes more, as the max drawdown came in at down -5.4% following the attacks on 9/11. But 7 out of the 10 saw the S&P 500 end higher over the following 12 months. Furthermore, the only 3 declines were associated with recessions. To quote one famous Cajun from 1992: “It’s the economy, stupid.” Almost 3 decades later, this sentiment rings as true as ever. While headlines of invasions, terrorist attacks, and wars are unnerving, to say the least, the fact is there’s no evidence supporting the notion stocks suffer. In fact, the data points the other way. But given our reticence to say bombs flying through the air are good for stocks, we’ll stick with this: don’t panic; stay the course.

What about oil? Well, historically, oil has experienced large spikes following events of this nature. How much? Over +40% on average compared to the long-term trend of +7% per annum over the same time frame. So it must be time to rush out and buy oil futures, no? Not so fast. We caution using historical data as a guide in this instance given the Middle East’s importance for oil markets has been drastically reduced by the rise of U.S. shale oil. We have no crystal ball, of course, but we don’t expect oil to be up +40% over the next year given the ability of U.S. frackers to turn up production.

Last 10 Major Middle Eastern Events.

Source: Data from Bloomberg. Events from Suntrust, NDR

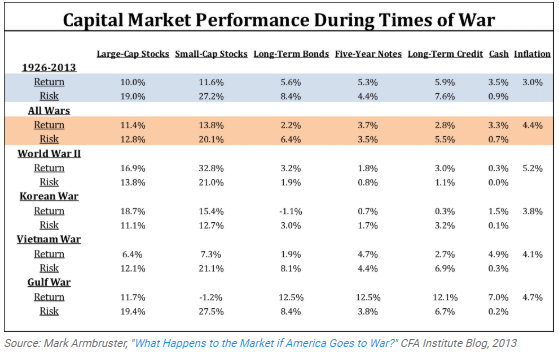

While we’re on the subject of war, let’s look at how stocks have done during wartime for the entirety of the S&P 500’s history (1926). To be clear, we are 100% hoping war is not the outcome, but we do believe it’s instructive to look at historical analogs when making investment decisions. Looking back to 1926 – 2013 (yes, the data we have is a little old, but the point would remain even with an update), stocks have actually done better during periods of war (+11.4% versus +10% on average) while bonds have suffered (+2.2% versus +5.6% on average). We can already hear the objections: how can this be!? It’s hard to say exactly but it would stand to reason that in periods of war government spending ramps up (both to pay for the conflict and to rebuild after), leading to more revenue and earnings for many companies and, thus, higher equity valuations. On the flip side, increased government spending tends to heat up inflation (4.4% during war compared to +3% on average) leading to higher rates and bond price underperformance.

But, but, but … it’s different this time! That’s true. It certainly could be. How so? Well, it does seem more likely these days a rogue nation such as North Korea or Iran could produce and deploy a nuclear weapon. We find it hard to argue this scenario could be good for stocks. So we won’t. More realistically, this time could be different given supply chains are much more global in present times. This could cause more pain for the U.S. versus historical analogs when the supply of goods never came into question. Take South Korea for example. South Korea now supplies around 40% of global liquid crystal display and around 20% of semiconductor supply. Said another way: another Korean War would likely have a vastly different impact than the prior iteration to U.S. markets.

Wars Tend To Actually Be Good For Stocks And Bad For Bonds. Relatively.

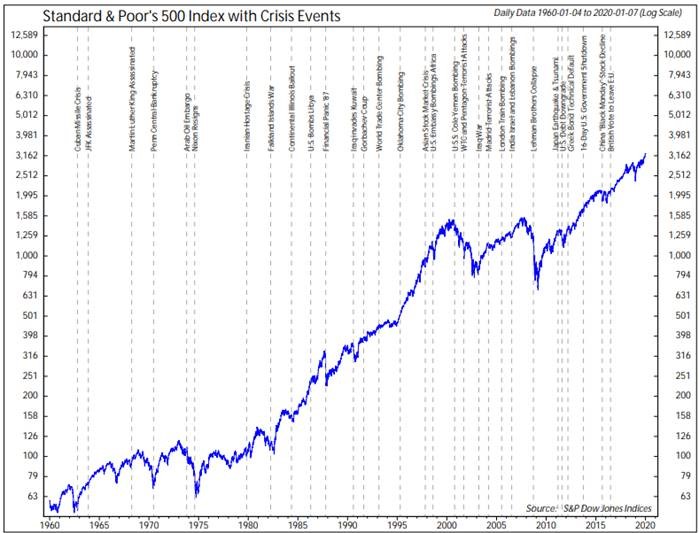

So, yes, it could be different this time. But, as always, we like to focus on the long-term. Over time it’s always different. And there are always ‘dooms-dayers’ who are happy to provide reasons to not be invested. That’s why we like to keep charts like the one below close by at all times. The market will gyrate. Events will spook investors. Stay the course. That’s the best advice we can provide. Over time, you’ll be rewarded.

In times like these, it’s also helpful to think about the long-term. Notice we’re higher than every major crisis since 1960.

This information is provided to you as a resource for informational purposes only and should not be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. There will be periods of performance fluctuations, including periods of negative returns. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions.