The government is back open! It seems all too common that we deal with the ineptitude of our policymakers. Too often it seem that these politicians worry more about being re-elected than they do about what is actually in the best interests of our country… and that is sad. Now that we have resolved the most recent issues in Washington, the focus turns back to the markets, for now. We will be having deja vu again in January as the government will be forced to have these talks again, and then they will be forced to tackle the debt ceiling debate again in February. Thus, despite the cheers from investors late last week, fiscal headline volatility will surely rear its ugly head to start the New Year.

But let’s look towards the rest of this year. Given how markets have reacted post the past government shutdowns, it looks as if we should be fine when it comes to 10 days after the shutdown. The median return for the S&P has been 0.9% 10 days after a government shutdown. Prior to a shutdown being resolved, markets tend to see negative returns; the median return during the shutdown has been -0.3%. But over this most recent shutdown, the S&P was actually up nearly 2.50%.

This positive reaction was likely due to the fact that an outline of a deal was reported prior to the deal actually being signed. This could be due to the advances in media that we have seen between the last shutdown and today.

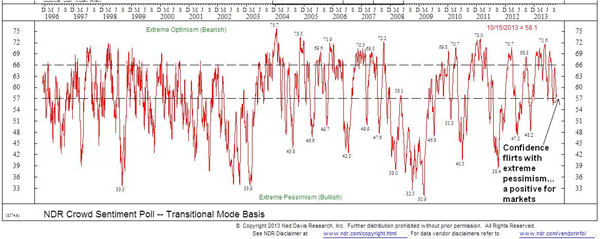

The shutdown and debt debate may not have had drastic impacts on the markets, but sentiment was definitely bruised. The NDR crowd sentiment index fell awfully close to extreme pessimism during the whole debacle. But now that we have the resolution in Washington, this provides more upside potential for markets heading into the end of the year.

The Fed deciding not to taper may have been a missed opportunity in regards to not having to possibly blindside investors with future tapering. But given the inability for Washington to govern and the likelihood of us facing these same issues again in January and February, the continued massive easing may be necessary to stabilize markets. So, the continued foot to the pedal in terms of monetary policy should provide upside potential within the equity markets.

Unfortunately, we are in a period of political paralysis in Washington and this will cause headline volatility for the markets. But the thing equities and markets still have going for them is that the economy is stable enough, at the time, to ward off some of this headline risk. Markets have the ability to quickly turn their attention back to the earnings, but volatility won’t subside until progress, not kicking the can down the road, actually occurs in Washington.