Sometimes you hear about people who retire and they say they’re going to play golf every day. Fast forward six months and they’re bored out of their minds.

What happened? If you call it a career but only have one or two hobbies or pursuits, chances are you’re not going to be very happy.

“To be precise, the happiest retired folks have an average of 3.6 core pursuits,” says Wes Moss, managing partner of Capital Investment Advisors in Atlanta. “Self-identified unhappy retirees report having just 1.9 such activities.”

Moss, author of “You Can retire Sooner Than You Think,” writes that just as it’s crucial to save enough money to retire on, it’s also crucial to have a variety of things to do, things that “flick your Bic.”

What are you passionate about? Tennis? Espionage novels? Painting? Doing volunteer work? Whatever it is for you—those are your core pursuits.

“These pursuits aren’t simple pastimes; they are passions to which the retirees devote a great deal of time, energy, and sometimes money,” Moss notes. “The happiest retirees give priority to their core pursuits and derive great satisfaction from those endeavors.

That’s not exactly a groundbreaking revelation, but what is new is the quantitative approach Moss has taken, which centers around a survey of more than 1,350 retirees in 46 states. The investment adviser had respondents rate their general level of happiness and the number of pursuits they had. The data was reviewed by the mathematics department at Georgia Tech.

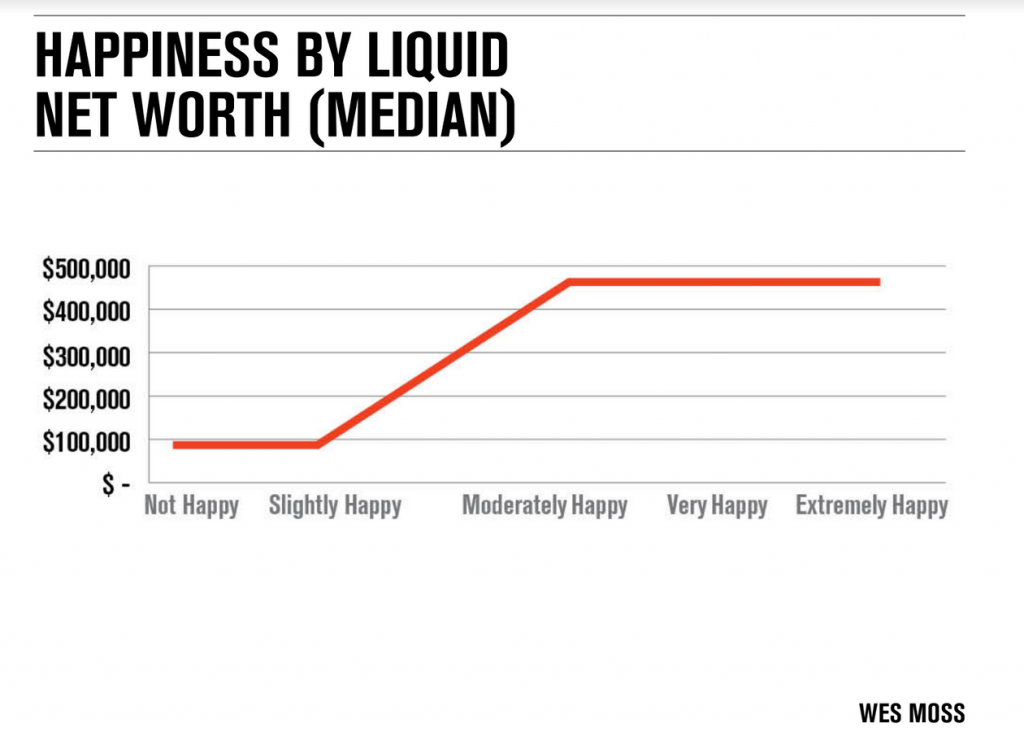

Moss’s research rejects the adage that “money can’t buy happiness.” He thinks it can. His data actually put a dollar figure on it. For example, retirees with a median liquid net worth of $100,000 tend to be unhappy. But as this grows to $500,000, retirees grow happier (remember: median means half have more than that and half have less).

Still, happiness is in the eye of the beholder. These days even a liquid net worth of $500,000, can’t be considered much, to give just one example, the often-cited rule that you can withdraw about 4% of your holdings each year to live on. This implies just $20,000, hardly a princely sum.

Such figures imply that most retirees aren’t too happy, given the overall dearth of retirement savings in the United States. I base this statement on Federal Reserve data reported last September that shows the average and median household net worth for households in the United States headed by someone aged:

But this is obviously misleading. Thus it’s the median figure—the midpoint of the 10 data points—that more accurately reflect the group. And that’s just $75,000.As you can see, if everyone was “average,” then everyone would be happy. But that’s not the way it works. For example, let’s say you have a group of 10 people and one of them is Amazon founder and CEO Jeff Bezos. He’s worth close to $200 billion. But the other nine people are worth $75,000. So the average net worth of this group of 10 people would be $20 billion and change. Wow! Talk about happy!

By Moss’s correlation between median net worth and happiness, it would seem happiness may be out of reach for many Americans.

But Moss also says, to his credit, that there are other determinants. His research also shows that “happy retirees” take about 2.4 vacations a year, while “unhappy” ones take about 1.5. A “vacation” is subjective: For some it could be a lavish European trip, for others, camping under the stars. The former is costly, while the latter isn’t. So you don’t necessarily have to lay out a pile of dough to get a little happiness.

And those “core pursuits” he mentions don’t have to cost much. I have a friend in his 60s whose goal is to watch every movie that ever won an Academy Award for Best Picture, Actor or Actress. All that takes is access to a classic movie channel. Other friends say they’re learning to cook or studying the Bible. Me? I like to write and am learning card and magic tricks.

Whatever it is, Moss emphasizes “while it is important to amass a retirement nest egg during our working years, it is also critical to find and develop our hobbies and passions…during our careers, core pursuits provide necessary diversions and stress-relief. In retirement, they provide all sorts of benefits, including physical activity, social interaction, mental stimulation, even a sense of purpose.”

Read the original MarketWatch article here.

This information is provided to you as a resource for informational purposes only and should not be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. There will be periods of performance fluctuations, including periods of negative returns. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions.