Once upon a time, a man stood on the moon’s surface. Looking back at the Earth, he couldn’t help but feel a sense of awe and wonder at its vastness. At that moment, he took a step back and imagined he was an investor in every company on the planet, with the entire population able to drive the fortune of all those businesses.

This line of thinking helped him realize that the true value of his home planet was not in any one corporate entity but in the collective efforts of billions of people working together to create goods and services and in the choices of their respective consumers.

He saw how population growth fueled the expansion of cities and economies, creating markets and driving demand for commodities old and new. He noted that productivity increases made it possible for people to generate more products with fewer resources. Finally, he marveled how innovation had transformed how we lived and worked — from the first telegraph to the latest breakthroughs in artificial intelligence and biotechnology, from carrier pigeons to high-speed internet.

But most of all, he saw how people all over the map were emerging from poverty, creating more aggregate consumption and fueling global economic growth. He realized that as the population grows, so does the economic pie — offering new opportunities for all willing to work hard and invest in the future.

As he gazed back at the third rock from the Sun, the man knew that the power of owning every company in the world came from harnessing a unified front of like-minded, inspired teammates working together to create a brighter future for all: a global army of productivity and economic progress.

Though he knew there was no air in space, he couldn’t help but feel a global version of what Warren Buffett calls the “American Tailwind.” He thought this is what Buffett must have meant when he said, “The pie gets bigger.” In a growing economy, the total shareable value increases over time. Neither the U.S. nor the international economies are zero-sum games. One person’s gain doesn’t have to equal another person’s loss.

How Does the Pie Get Bigger?

As the world’s economy grows, there is more wealth to be shared by everyone, with the hope of increased prosperity and higher living standards. Let’s examine some examples of how the world economy grows and just how that pie actually gets bigger.

1. Global population growth has averaged about 1 to 2 percent per year.

Over the past one hundred years, the global population has grown at an average annual rate of about 1.4 percent. In 1920, the world’s population was approximately 1.8 billion, and by 2020, it had ballooned to 7.8 billion. In other words, it more than quadrupled.

To be clear, the population growth rate has slowed over time. In the early part of the Twentieth century, it was close to 2 percent, but since then the rate of increase has moderated. But despite the slower pace, the UN projects continued growth, estimating 9.7 billion people by 2050 and 10.9 billion by 2100.

2. Productivity growth has averaged about 1.9 to 2.3 percent per year.

In the US labor productivity (output per hour worked) has increased by an average annual rate of about 2.3% from 1948 to 2019, according to data from the Bureau of Labor Statistics. Over the entire 20th century, the annual rate of increase was about 1.9%.

3. Over 1 billion new consumers have been added to the global economy over the last thirty years.

How many people moved out of poverty in the last thirty years? Of course, the percentage can vary depending on how poverty is defined. However, based on the most commonly used measures, we can assess a few key facts.

According to the World Bank, the global poverty rate, the percentage of people living on less than $1.90 per day, fell from 36 percent in 1990 to 8.6 percent in 2018 (the latest year for which data is available). That math translates to over to more than 1 billion people climbing out of poverty over that span and into the global economy!

4. The S&P 500 earnings growth rate has averaged 6.8 percent over the past fifty years.

The average annual growth rate of S&P 500 earnings over the past fifty years (1971 to 2021) was approximately 6.8 percent, according to data from S&P Global. This average includes periods of solid earnings growth but also includes periods of steep decline, such as the recessions in the early 1980s, the Dot-com bubble in 2000s, the Global Financial Crisis of 2007-2008, and the COVID-19 recession in 2020.

It is important to note that past performance does not guarantee future results, and there can be significant fluctuations in earnings growth rates from year to year, depending on various economic and market factors. But even despite that, the numbers are fascinating.

What Does All This Equate To?

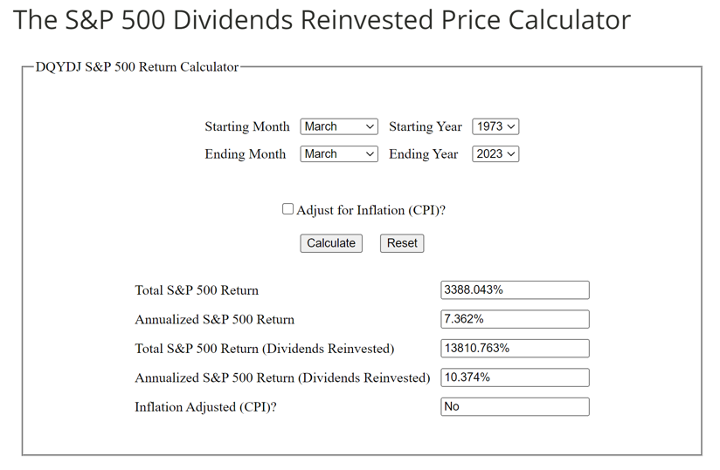

The sum of population increase, the productivity increases, and the earnings growth from the S&P 500 you get a total of somewhere between 9.7 -11.1 percent. Is it a coincidence that the S&P 500, an index famous for companies that harness the power of innovation and productivity, has come close to matching the same rate?

Source: https://dqydj.com/sp-500-return-calculator/

Bottom Line

Despite World War I, World War II, the Korean War, Vietnam, the Great Financial Crisis of 2008, the Covid Pandemic of 2020, and even near catastrophes such as the Silicon Valley Bank collapse, we continue to find a way to grow.

We can’t always prevent bad things from happening in the world or the stock market. But if we react with patience and stick to the principles with which we began our retirement planning journey, we can continually move forward with an enriched context to create a better world.

As you prepare for retirement, let market history, growth data, and population trends give you the benefit of a broad perspective. Be like the man on the moon — visualize the global economy as an inspired team marching toward prosperity. Invest in the future and be patient enough to let it invest in you.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. There will be periods of performance fluctuations, including periods of negative returns and periods where dividends will not be paid. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions,