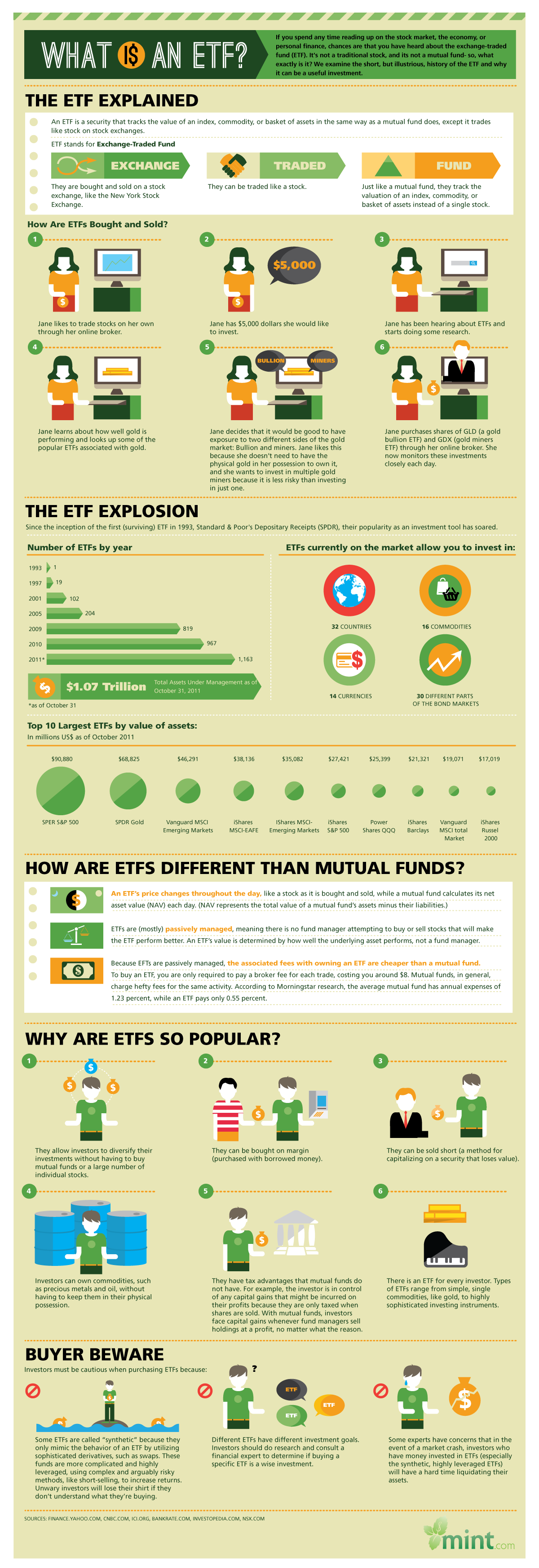

When discussing options for Income Investing, we often reference ETFs or Exchange Traded Funds. In this post, we want to take the opportunity to discuss five of the key features for ETFs.

We found this excellent infographic that gives a detailed explanation of how it works on mint.com. And here’s the top tips to remember:

1. ETFs are bought and sold like stocks, can be traded like stocks, but also share many of the same properties as a mutual fund because they track the valuation of an index.

2. ETFs allow you to invest in foreign currencies, commodities, different parts of the bond market, and even countries.

3. ETFs can be bought on margin or sold short.

4. ETFs have tax advantages that mutual funds do not have. For example, the investor has more control over capital gains.

5. Different ETFs have different investment goals so you should consider seeking the advice of a financial professional before making your first investment.