The recent rise in interest rates has many investors reconsidering bonds, and with seemingly good reason. Interest rates and bond prices move in a seesaw pattern. When interest rates go up, bond prices falls. This reality has even conservative investors questioning whether or not bonds still have a place in their portfolio.

But before ditching your bonds, consider the following:

When will interest rates actually rise? Despite a recent and steady increase from historic lows, rates may linger at current levels for some time.

Not all bonds are created equal – There are nearly a dozen unique bond varieties, all of have dramatically different reactions to rising interest rates.

Bond Stability – Compared to stocks, commodities, REITs, etc. bonds provide significant price stability.

I want to address each of these issues in depth. But first, let’s review the basics of bonds. Bonds are simply IOUs issued by a company or government. Here’s a simple bond example: When you buy a 5-year bond for $10,000 the seller is using the $10,000 for that specific term, while at the same time paying you an annual interest rate. At the end of the term (the bond’s maturity) you get your $10,000 back. Over the whole term you’ve collected $500/year, (5% on $10,000), and had your original principal returned. This is, of course, provided that the entity that issued the bond stays solvent and has the ability to pay the full bond value back.

How often do bonds default? It depends on the kind of bond. As for US government bonds, they are the gold standard of credit. However, plenty of international government bonds have defaulted (think Greece and Argentina). According to Carmen Reinhart from Harvard’s Kennedy school, the US government has not defaulted since the late 1700s. This makes US debt “risk-free” from default in the eyes of global investors. Corporate bonds are also considered to have a low probability of default, with the average default rate of less than ½ of 1% over the past 50 years. High-yield or junk bonds paint a slightly different picture, with an average 20-year default rate of 3.9%.

When will rates actually rise?

At the beginning of 2014 67 out of 67 economists cited in a Bloomberg News report predicted a significant rise in US interest rates as measured by the US 10 Year Treasury Bond. By the end of that year, 67 of that economist were wrong. In January 2014 the 10YT hit 3%. At year’s end it was closer to 2%. How’s that for a rate uptick?

Similar predictions have been widespread since 2010. Imagine if you sat out of the bond market thinking rates would rise for the past 7 years? In cash, you would have earned about 0.7% (0.1%/year X 7 years). Versus, the US core aggregate bond index ETF (AGG) which has a total return of 27% or 3.5% per year.

I’m not suggesting rates won’t go up from here (they currently hovering around 2.5%), but predicting interest rates and the fate of the bond market has proven over time to be just as fruitless as predicting the exact peaks and vales of the stock market.

Not all bonds are created equal

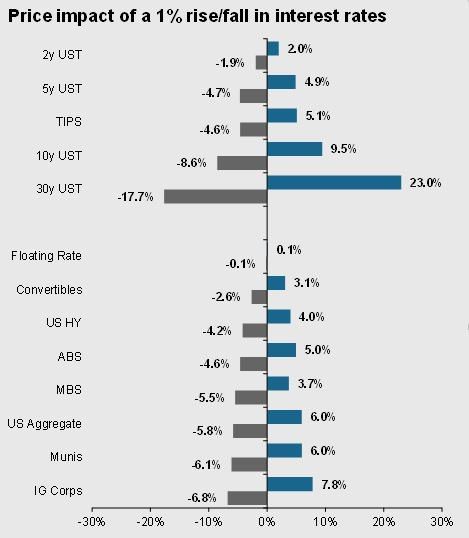

A one percent rise in interest rates will have very different effects on different bond categories. In Wall Street parlance a bond’s duration helps forecast a bond’s price reaction to a change interest rates. For instance, very long-term bonds (30-year US Treasuries) will fall 17.7% when interest rates rise 1% while Floating rate bonds stay virtually flat (see chart below). Keep in mind that this doesn’t account for the income you receive in a given year. So, in the case of floating rate bonds, convertible bonds, and US high yield bonds, the average income (interest) paid will often lead these categories to a positive total return, despite the headwind of rising rates.

Bond Stability

Bonds provide price stability that few other asset classes can offer. A bad month for stocks can mean a 17% tumble. A terrible month for bonds might result in a 2.4% dip, as we saw in November 2016, the worst month for bonds in 12 years. The right categories of bonds can help dampen wild portfolio swings, regardless of the interest rate environment.

Because investor emotion is such an important variable in long-term returns, less portfolio risk is often a good thing. According to a recent DalBar study, over the last 20 years the S&P 500 has registered an 8.2% gain and bonds a 5.3% gain. A balanced 50% stocks and 50% bonds portfolio averaged 6.75% per year. However, due to timing errors based on fear and greed, the average investor has generated an only 2.1% annual gain!

Think about this: going to back to 1950 the best year for stocks is up 47%, while the worst was down 39%. A 50/50 portfolio only registered a *33% gain as its best year, but its worst was only down 15%.

*JPM Asset Management Guide to Markets Q1 2017

Above all, we own bonds for consistent income

Remember, we primary reason we own bonds for the income they generate from a consistent coupon payment. So we own bonds (in the form of individual bonds, bond ETFs, or bond mutual funds) for their various yield outlooks. Currently, government bonds yield between ½% and 3%, while corporate bonds pay between 2% and 4%, and high-yield bonds offer 4-6% per annum.

In any given year this may not sound like a lot, but taken over a decade those little numbers can add up to significant returns.

So, with interest rates rising, do bonds still have a role to play in your portfolio? Absolutely. I’ve heard the bond question answered like this, “They pay income. They move less than stocks, mostly in opposite directions. Buy bonds now. Smile later.”

Read the original article here.