As we close out the second quarter of 2018, we wanted to address a common question we’ve been getting from clients, friends, business partners – and even a couple of our own mothers. Will the Trump tariffs shoot down our high-flying economy and stock market?

Our economy is firing on all cylinders as we cruise along into the ninth year of a tremendous bull market. Since the beginning of this run, the Dow has quadrupled, while the S&P 500 has also enjoyed big gains. The Atlanta Federal Reserve Bank recently upped their fourth-quarter GDP forecast again, to almost 5% growth, or 4.7%, to be precise.

Still, markets have recently sold off significantly from their highs. The fly in the ointment? Fear about tariffs and trade wars.

Let’s talk through the numbers behind the tariffs, both at home and globally.

Since January 2018, when President Trump made his pronouncement, we’ve been immersed in tariff talk, starting with the 25% tariffs on steel and the 10% on aluminum from the European Union, Canada, and Mexico.

But the area of most concern lies with China. Of course, you’ve heard of the $50 billion tariff on Chinese goods, and their retaliation to the tune of $50 billion on US goods, also. And just recently, I’m sure you’ve heard that our president has indicated the potential for another $200 billion in tariffs, and the possibility of 20% tariffs on all European automobiles. As if we needed any more bricks in our wall of worry.

There is little debate that tariffs, operating in a vacuum, are bad business for the US. Why? Because they can cause inflation, they can cause commerce to slow down, and, in essence, they block the natural flow of where capital is supposed to go when traveling in the most efficient manner.

Those sound like scary headline numbers and outcomes, but let’s break down the numbers behind the headlines.

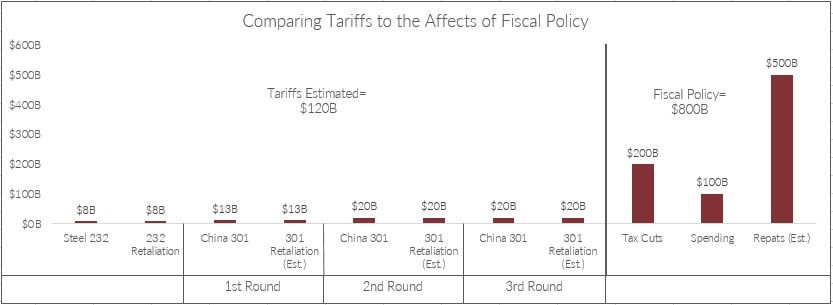

Remember that the headline figures are not the actual costs. The real cost of $50-billion of targeted products at a 25% rate would be $12.5 billion. And a 10% levy on $200 billion worth of products costs $20 billion. If we add up the actual costs of all the announced tariffs so far, we’re at about $120 billion.

So, we know that the economic impact on the US, right now, is about $120B to the negative. Contrast this figure with the roughly $800 billion in positive economic stimulus we have coming. It’s a seven-fold difference; the benefit of tax reform outweighs the harm of tariffs by almost seven times.

I believe Washington is aware of this math. They know the economy has the leeway to absorb the short-term downside of this negotiation process. And this is absolutely a negotiation.

Take a look at the chart below for a visual of this point. For reference: Fiscal Policy is showing the benefits of tax cuts, new federal spending, and repatriations related to corporate tax reform. The Tariffs Estimated are showing the estimated actual costs to the economy from new tariffs and anticipated retaliatory tariffs.

Of course, there’s no doubt that the economic impact of this trade skirmish (not war, as we discuss below) is growing. But it’s interesting to see how this skirmish is affecting Chinese markets…

For comparison, the Shanghai SSE Composite Index, measuring large-cap Chinese stocks, is down almost 15% this year, versus the S&P 500 which has eked out a small gain year to date. This is an indication that there’s even more pressure building up on the Chinese economy relative to the US. Perhaps this negotiation may place us on a more level playing field with China.

While we import over $500 billion from China every year, China only imports $130 billion from the US. They have already responded with tariffs on a large portion of those imports. So, how much ammunition do they have left?

Clearly, this won’t be over anytime soon. In the end, however, I believe we will come out with a more level playing field, and we will have taken at least the right step with intellectual property rights, and changing this trajectory is important. In my opinion, steps towards this end are exactly what the US are taking right now.

Will our strategy and negotiations work? Only time will tell, but I believe in America’s fortitude, industry, resilience, and leadership. When all is said and done, we stand to gain some ground economically, and even strengthen our trade relationship with China. After all, both economies need one another.

DISCLOSURE

This information is provided to you as a resource for informational purposes only and should not be viewed as investment advice or recommendations. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions.