This past weekend, I spent some time drawing out different baseball situations for my little league team that I coach. After our recent practices, it was determined that visuals would help simplify the game for this group of kids. They are talented and athletic, but the situational aspects of baseball can confuse anyone.

As I was drawing out each of the different situations that occurred, I quickly remembered there were an infinite number of scenarios, but most importantly I remembered that situational baseball is what makes the game so great.

The key to any of the situations on the diamond is making sure everyone knows what their responsibility is and that everyone is in every play. To simplify each situation, players must know where to go for their particular position. If you try and explain where every player goes at one time, players will get confused. Looking at a diagram of how a play should unfold can be confusing, but looking at what a player needs to do individually is very simple. Then, when you put each simple movement into play, you create a baseball masterpiece.

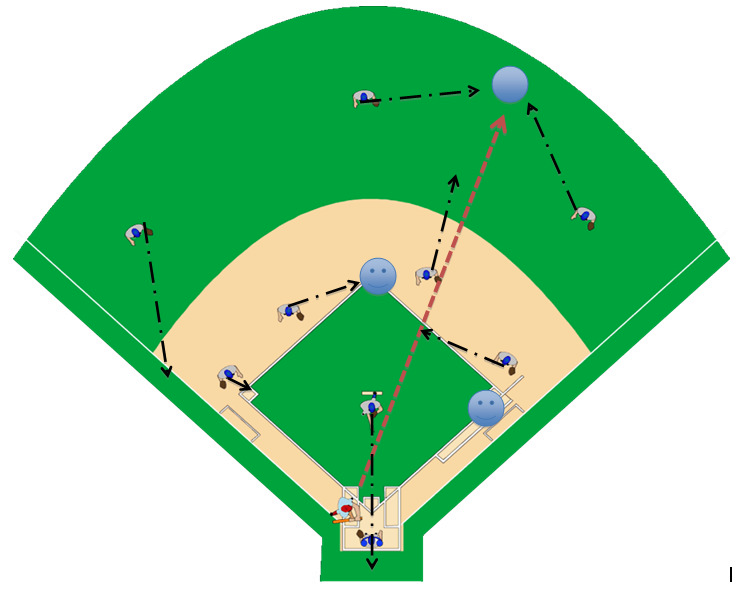

Here is an example. Looking at the diagram without explanation can seem confusing and the write up may be as well. With this play, you have runners on first and second. The left fielder and center fielder go for the ball while the first baseman becomes a cutoff man for a play at home. The second baseman moves out to the outfield to be a cutoff man for second base or third base. The shortstop covers second base, while the third baseman stays on the bag and the left fielder runs in to back up third, while the pitcher backs up home. Everyone is now in place for a successful play.

But just showing this picture or just explaining as I did in the prior sentences should confuse anyone. But showing this picture and saying just look at the shortstop or the first baseman, simplifies everything. And if each player runs to their respective spot, rather than worrying about another player, the play will create baseball harmony.

Investing is very similar. Complexity is a very basic way of describing investing and trying to simplify the process can be difficult.

We have stocks and bonds, whose values are driven by different data points, but they also have similar data points that impact both of them. The scenarios that we are planning for within an investment portfolio are ever changing and infinite.

For instance, as we headed into 2014, hopes were high and many people felt the bull markets would continue. Optimism was high. Then came January and a 3.5% drop in the S&P 500, whoops. Moods swung to the other side of the spectrum and fears began to come back.

With bonds, expectations were for yields to spike as tapering continued into 2014. Well the majority was again, at least for January, wrong. The 10-year Treasury yield fell 39 basis points in January to yield 2.64%, whoops again.

February’s outlook turned sour as the majority thought a major correction was upon us and the portfolio adjustments began to try and steer clear of such a fall. Well, so far in February markets are up 3% and the 10-year Treasury has seen its yields rise 10 basis points.

Despite being such a short time period and definitely not reflective of what could ensue for the whole year, it’s a good sample to draw from. Trying to determine how to position portfolios on the recent history or recent headlines or recent feelings doesn’t tend to work to well, as we have seen early in this year.

Rather each investment within the portfolio should serve a purpose; whether the purpose is to protect value when equity markets fall or appreciate when equity markets grow, each investment has a job. Trying to get an investment that does both of these things and building a portfolio of these types of investments doesn’t work longer term.

So, just as empowering each player on the baseball field to do one job produces baseball masterpieces, having each individual investment in a portfolio for a particular situation will create investment Picassos.