One of the most popular Christmas songs of all time is one you may not have heard. Far from a carol, “Fairytale of New York” is a moody dance ballad by the Celtic punk-folk band The Pogues, featuring Kirsty MacColl. A perennial Christmas hit in the UK and beloved worldwide, in December 2022, the song was certified quintuple platinum in the UK for 3 million combined sales.

What does this have to do with American anxiety amidst a healthy economy? Stay with me, I promise to connect the dots.

The song tells the story of an Irish immigrant couple who made it to the land of prosperity, where dreams come true. Yet, despite seeing ‘cars big as bars’ and ‘rivers of gold,’ life in New York City has not lived up to its promise. Nostalgic for what never was, angry about what isn’t, and hopeful for what may never come to be, this couple finds itself full of anxiety even as a happy choir sings and the yuletide bells ring out on Christmas day. Dreams deferred but love not unrequited; the irony is layered thicker than the musk that surely wafted through the dingy pubs this troubled twosome frequented.

Americans today find themselves sandwiched between similar dichotomous sentiments. In short, they feel bad about a good economy.

According to a study conducted by Qualtrics on behalf of Intuit Credit Karma, 96 percent of Americans are concerned about the current state of the economy, and more than a quarter (27 percent) “doom spend” as a way to cope with the stress of it. As one might guess, this has resulted in more cumulative debt, as nearly one-third (32 percent) have heaped more dead weight upon their credit report in the last six months.

A September Suffolk University Sawyer Business School/USA Today poll asked Americans for a word that best describes the economy. The vocabulary entries were not positive—horrible, chaotic, sad, struggling, and scary filled the list. Three out of every four people volunteered terms that reflected concern. By more than three to one, those surveyed said the economy was getting worse, not improving.

If people feel so blue about the economy, it must be bad, right? Well, the numbers tell a different story.

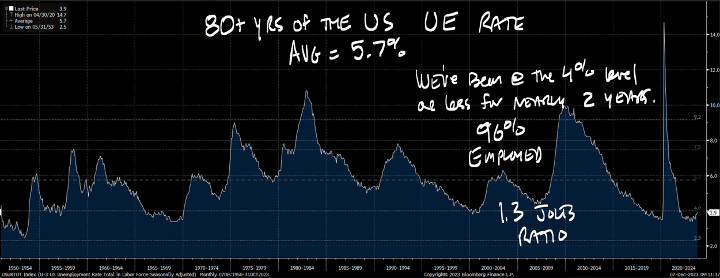

Source: Bloomberg as of December 7, 2023

The Bloomberg chart above says it all. For the past eighty-plus years, going back to 1950, the unemployment rate has averaged 5.7 percent, yet we’ve been at 4 percent or less for the better part of two years. So, according to these numbers, 96 percent of people are currently employed, with 1.3 job vacancies available for every one person looking. For context, the Federal Reserve tries to keep the unemployment rate around 5 percent. In other words, things right now are highly favorable relative to economic history.

Again, we must ask, why do people feel so much existential dread about an economy that is anything but dreadful?

I promise I’d share if I had a black-and-white answer, but the truth is that life is usually more about the grey. The best we can do is look at possible pressure points and consumer behaviors.

- The impact of inflation has set in, and it hurts. In 2022, we had some initial resilience around it. Now, two full years into a 20 percent inflation rise over the past three years, inside of an overall 30 percent rise over the past ten years, the family budget is hurting.

- Cutting back. About seven in ten are limiting meals out and spending fewer dollars on clothes. Nearly six in ten are delaying home improvements and canceling vacations. More than half are spending less on groceries and trying to save on electricity costs by dialing back the thermostat settings.

- More debt. Four in ten, or 39 percent, said their household debt has increased over the past year, more than doubling the 18 percent who reported a decrease. Nearly nine of ten said they don’t plan to buy or sell a home in the next twelve months, with more than one-third stating they simply can’t afford it.

- Savings drain. Thirty percent say they’ve had to cut into their savings to pay bills, and nearly as many disclosed that they’ve saved less money than usual over the past year.

It’s usually easier to make a negative case about the economy and stock market because you can use current data to buttress opinions. And is anyone ever totally satisfied with their lot in life? We all want more money and fewer expenses. It’s rare to look at a grocery receipt and celebrate the cost. And with prices higher than usual, we feel like underdogs struggling to defend against a more powerful opposition.

Looking for future optimism requires a forward glance into unclear and undetermined territory. Even if we’re aware of positive trends, it’s tough for the brain to convince the heart. Our feelings often grab the steering wheel. For instance, the Q3 gross domestic product (GDP) just grew by over 5 percent. That’s a champagne-popping percentage, yet 96 percent of people are in no mood for a celebratory sip of the bubbly.

No matter how good things are, a drop of bad news overshadows the day. News outlets report discouraging scenarios even when many economic signs say otherwise. I’m certainly not trying to diminish any hardships brought about by higher prices and other inflationary challenges. But the math is the math. That’s why so many of us dreaded the subject in school—its accuracy doesn’t require our approval. Its data isn’t dependent upon our feelings.

“Doom spending” isn’t a new phenomenon. In my day, it was called “retail therapy.” But that’s a far less ominous headline, so it’s been rebranded for maximum views. God bless the media; they know how to grab our attention. Bad and scary get more clicks than good and safe—the fear of doom snowballs into real doom. People simply can’t get ahead if they have a highly negative opinion about the state of work, business, and the economy. We must resist this to look for and invest in optimism.

The long-term answer comes back to the hero that’s saved us time and time again: the army of American productivity. It’s why so many other countries invest in ours and why US dollars are the world’s most widely used reserve currency. It’s why the Irish protagonists of the Pogues’ hit Christmas song dreamt of crossing the Atlantic where Broadway was waiting, Sinatra was singing, and people danced through the night.

Instead of high gas prices, think about strong consumer spending. Rather than unfavorable mortgage rates, focus on the rising median net value (home equity) of houses. Sure, growing debt isn’t great, but growing 401(k) values are!

I’m not trying to sell you on a fantasy. There are several genuine pieces of negative economic news, and they should not be discounted. However, plenty of uplifting developments don’t make it to the headlines. The last few years have been stormy. But the forecast is calling for calmer skies ahead.

Enjoy the holiday season.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. For stocks paying dividends, dividends are not guaranteed, and can increase, decrease, or be eliminated without notice. Fixed-income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed-income securities falls. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions,