Inflation has dominated financial conversations for quite some time, and rightfully so. The Federal Reserve (The Fed) recently raised interest rates by a quarter of a percentage point, totaling five full percentage points since March 2022. Remember, the Fed helps combat rising inflation through raising interest rates. However, we may finally be at or near the end of a rising interest rate environment. Don’t just take my word for it, take Fed Chair Jerome Powell’s. He went as far as to say, “We’re closer, or maybe even there,” referring to the finish line of rate increases.

Inflation, as measured by the Consumer Price Index (CPI), dropped in April 2023 to the lowest level consumers have seen in two years. Was that welcome news? Definitely. But does that metaphorical sigh of relief translate to more money in your pocket? Not necessarily. It’s safe to say many Americans don’t feel any less financial pain than before rates started dropping.

Combat Wilting Dollars

We’re living in a period of wilting dollars. Let me explain.

For some, their wallets have been lighter because they had to buy a new or used vehicle, and the sticker price was more than they wanted to spend. Or, maybe it was the family vacation, groceries, school clothes for the kids, diapers, baby formula, and so on. Others may have had to transfer money out of savings to cover a monthly bill increase. Or maybe the 40 percent rise in home prices meant they refrained from buying that house for which they’d been saving.

All this gets discussed within the premise of “when will the rate of inflation get back to a more normal level of 2 or 3 percent?” However, I think we’re putting our focus on the wrong number. The rate of inflation will very likely continue to ease, but how much higher are prices now, and will they remain there forever?

Even if the inflation rate magically fell to 0 percent next year, that would only mean the surge in prices had stopped…and it would do nothing to have reversed the surge we’ve seen in overall price increases. Consequently, we need to look at the more permanent impact of higher prices and identify what can we do about it.

Let’s look at the following examples.

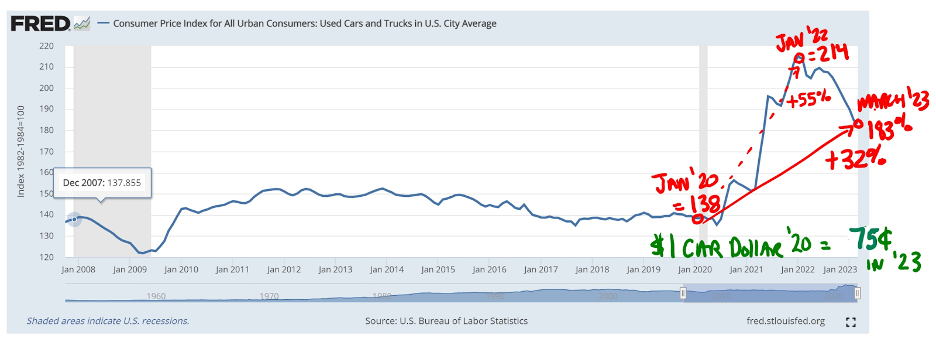

The Bureau of Labor Statistics (BLS) keeps track of used car and truck prices between two and seven years old. Subcompacts, compacts, intermediates, full-sized, and luxury cars, as well as light trucks, pickups, vans, specialty, and sports utility vehicles, are all included in the index.

Used car prices shot up 55 percent from 2020 to 2022. Since then, prices have fallen 14 percent, but that’s still a net increase of 32 percent. So the used truck that would have been $20,000 in 2020 is now approximately $26,400 — taking an extra $6,400 out of your budget. That $6,400 expenditure might mean the cancellation of a family trip or the underfunding of a retirement account.

We naturally view all of this through the lens of the current price vs. the previous price. So if cereal is a couple of dollars more than it was, it’s annoying but not the end of the world, right?

But now, let’s look at it in reverse. Presuppose that every dollar in your budget is earmarked for a particular expense. You have food dollars, gas dollars, car dollars, etc. Using car dollars as an example, set the baseline of a $1 value in January 2020, right before the pandemic. Today, that same dollar is worth about seventy-five cents. Inflation looks a lot more real from this angle.

You don’t have less money, but your money is worth less. That’s what I mean by the wilting dollar!

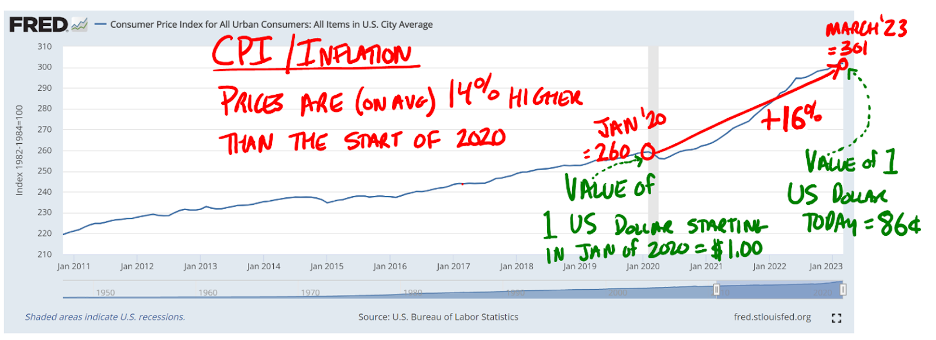

Now, let’s look at what inflation has done to every dollar in your wallet, income, outflow, and savings.

The overall CPI level was 260 in January 2020, whereas you can see on the chart above that it’s 301 today. That’s a 16 percent increase in aggregate prices, which includes major categories — everything from eggs and bread to beer to gasoline and even airline tickets.

In other words, today’s dollar, the one that was worth $1 in 2020, is now only worth eighty-six cents.

No matter what happens to the inflation rate, it’s improbable that the eighty-six cents will ever return to being worth a dollar. That is unless the economy plunges into deflation, which presents its own set of problems.

Bottom Line

The good news is that the United States economy powers so many inflation-resistant investment opportunities to help folks plan for and achieve a happy retirement. From growth stocks, dividend stocks, mutual funds, ETFs, real estate funds, energy funds, energy pipeline funds, and beyond, the more assets we can keep outside of cash, the more we have the potential to protect ourselves from wilting dollars. Equity investing is designed as an inflation elixir. As with most things in life, it’s not without risk, but there are sensible ways to proceed based on historical trends and diversification.

I understand that the U.S. has its share of problems: political divisions, the environment, national debt, the war in Ukraine, and tensions with China. It’s all concerning, and any of those can have severe personal and financial implications. But when you look at the stark reality of wilting dollars, to battle against the inevitable decline in your purchasing power, is to keep up with and outpace inflation. The optimal way to do that is to prioritize getting your dollars out of your wallet and into something that should keep pace over time.

If you’re sitting on the sidelines due to fear and pessimism, you could risk letting your dollars wilt. I’m not blindly optimistic, but I do believe in the army of American productivity and the US equity markets. We’re lucky that its’ growth opportunities can help shield us from the perils of inflation over time.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.