Several different categories of preparation are required to find happiness in retirement, but let’s be honest—the financial one is huge. If you don’t have enough funds to replace your paycheck, it will be tough to do much else. As a financial advisor, it’s my job to help folks optimize their options.

My latest book, What the Happiest Retirees Know: 10 Habits for a Healthy, Secure, and Joyful Life, uses the data from my extensive surveys and research to lay out the three financial habits that the happiest retirees on the block (HROBs) have in common. I recently spoke to a group of Georgia State Employees about this topic, and it got me fired up to re-share those habits to help more people plan for the future and live a happy retirement.

Ready? Here we go.

Habit #1

Have at least $500,000 in liquid retirement savings.

As a reminder, liquid retirement savings are funds that you can access easily. Some examples are stocks, bonds, mutual funds, and cash.

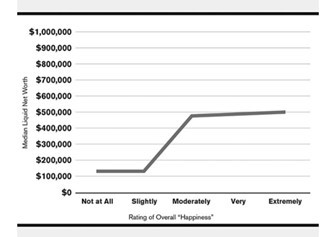

$500,000 is the number I landed on after combining my professional experience and extensive research. Of course, there are happy retirees with less than $500,000, but we found this level to be a critical inflection point. Having more is fine, but due to what I call the Plateau Effect, we see significant improvements in happiness levels from $0 to $500,000. Once we get above $500,000, happiness tends to level off.

The chart below demonstrates the rate of happiness according to liquid net worth.

Everyone’s economic needs vary, but this number is an excellent bellwether for retirees who carry little debt and don’t live an extravagant lifestyle. If it sounds high, don’t panic. I know it takes a lot of time and hard work to accumulate that wealth. It’s much more attainable than the figures you’ll hear thrown around by some of the retirement “gurus” out there. Suze Orman once claimed folks needed at least $5 million to retire. Many happy retirees I’ve surveyed have far less, yet they were still able to stop working and live joyful, fulfilling lives. Suze may want you to work for the rest of your life, but I don’t.

Happiness in retirement is about being committed to a simple plan and taking that first step. If you do that, you’ll be surprised by what you can accomplish.

Habit #2

Be within five years of a mortgage payoff.

I’ve found that happiness is within reach when the end of the mortgage is in sight. Based on the extensive analysis I conducted for my first book, You Can Retire Sooner Than You Think, I believe the happiest retirees enter post-career life mortgage-free or within five years of being so.

The opposing argument is that you can make more money if you keep your mortgage and invest your savings. This argument relies on the premise that the interest paid on the mortgage will equal less than the interest earned in the market.

I like using the One-Third Rule which says if you can pay off your mortgage using no more than one-third of your non-retirement savings, consider doing so. By non-retirement, I mean a brokerage or savings accounts and not 401(k), IRA, or other retirement savings plans from work. So, as an example, if you have $150,000 in non-retirement savings and only owe $40,000 on the mortgage, you might want to consider paying off your mortgage.

If you need more to be convinced, consider how a mortgage affects your emotional health. I’ve learned from the happiest retirees that a real sense of peace and serenity comes with owning your home free and clear. Happy retirees love not having to write that monthly check to the bank. It also dramatically lowers your monthly retirement living expenses, taking the pressure off your nest egg and other sources of monthly income.

For all these reasons, I think the pros of paying off the mortgage outweigh the cons.

Habit #3

Have multiple streams of income.

This habit was fun to point out to the Georgia State Employees because many have a pension to collect. Unfortunately, most of us aren’t that lucky, but we can still create multiple income streams we need for a happy retirement.

Consider all possible retirement income streams: paychecks from part-time work, Social Security, income from rental properties, investment earnings, pension income, etc.

HROBs have to figure out how to generate money in retirement because you won’t have that nice, big paycheck. You must change your mindset and try to build multiple, smaller income streams. Essentially, you’re creating as many tributaries as possible to come together into one new, predictable larger river of income!

Following these three habits can set you on the right path to retirement happiness. The trick is to balance today’s cost of living with the need to save for tomorrow. Prepare for a secure future without sacrificing happiness in the present.

Don’t let anyone tell you that you can’t be a happy retiree. One of the best parts of my job is seeing so many folks absolutely loving their second-act lives. Of course, it takes effort and planning, but if you emulate the financial habits of the HROBs, you’ll be well on your way!

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. There will be periods of performance fluctuations, including periods of negative returns and periods where dividends will not be paid. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.